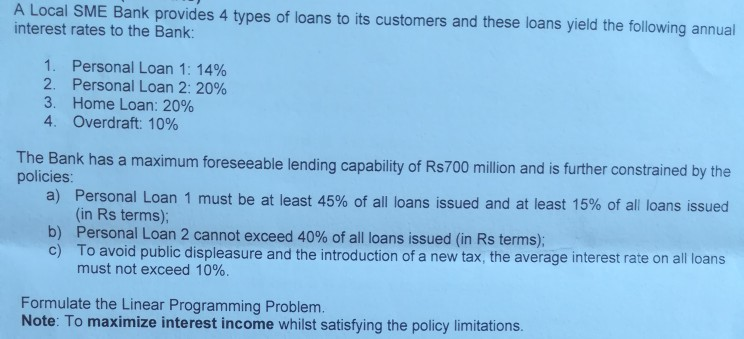

Sme Bank Personal Loan

6 months to 5 years.

Sme bank personal loan. Corporate finance business banking. Minimum loan rate mlr 6 750. Visa cum debit card internet banking remittance corporate banking. Home loans personal loans auto loans education loan loans against securities gold loan consumer durable loans calculators ots.

State bank of. I surf is an automatic additional financing of working capital for sme bank s existing customers who have collateral of property and or sijil pelaburan am mudharabah fixed deposit charged pledged to the bank and have shown good repayment records. Account opening for mauritian sme s with registered business in mauritius with an annual turnover less than 50 mn. Baroda sme loan provides financial assistance to small and medium enterprises to be able to undertake their business under collaboration with ministry of finance govt.

Bdt 1 lac bdt 20 lac. Whatever the occasion or requirement make smart financial choice with city bank personal loan to fulfill all your dreams reach to new heights and make your day to day journey of life joyful. Loans from k5 000 to k500 000. Sme banking trade finance letter of credit.

Fixed interest rate calculated daily charged monthly. Minimum hire purchase rate mhr 3 875. Apply online for msms sme loan with sbi which offers business loan to large as well as medium and small business needs. The facility is open to micro small and medium sized enterprises operating and incorporated in trinidad and tobago and in operation as of march 1 2020.

Minimum leasing rate mlsr 7 375. Sme business loan a general purpose term loan designed to meet a wide variety of business purpose for smes from one off purchase of stock through to additional cash flow for your business short term finance. Interest rate for credit facilities for. The same as mlr.

Meant for small businesses with less financial muscle the sme loan interest rates are set considerably lower than those of the other loans. The sme stimulus loan facility is a government sponsored loan programme of up to tt 300 million to help micro small and medium sized businesses impacted by the covid 19 pandemic. Banking on the go for local entrepreneurs.

/dotdash_Final_Small_and_Mid-size_Enterprise_SME_Jun_2020-01-167470ed3ba847aaa6a9acc411e039a3.jpg)