Singapore Income Tax Calculator 2020

If you make s 85 200 a year living in singapore you will be taxed s 18 148.

Singapore income tax calculator 2020. The information in this summary is intended to be no more than a general overview of your tax position. Mr heng is entitled to ptr of 5 000 in respect of his first child born in 2019 which is used to offset his income tax payable for ya 2020. The 2021 e file tax season starts in january 2021. This page is currently being updated for tax year 2020 tax returns due on april 15 2021 for now use the current tax year 2019 tax calculators due on july 15 2020.

Singapore income tax calculators for 2020 21 this section contains online income tax calculators for singapore. Singapore income tax calculator 2020 21. This marginal tax rate means that your immediate additional income will be taxed at this rate. That means that your net pay will be s 67 052 per year or s 5 588 per month.

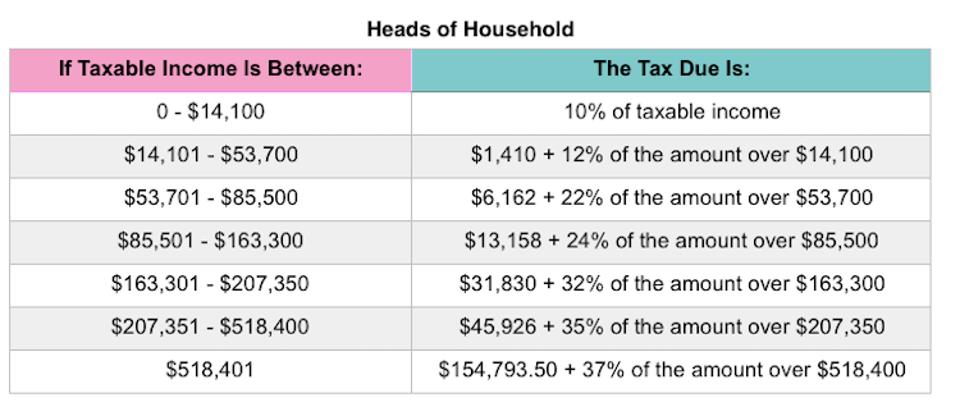

The singapore income tax calculator is designed for tax resident individuals who wish to calculate their salary and income tax deductions for the 2020 assessment year the year ending 31 december 2019. Income tax calculator for tax resident individuals. Compute income tax liability for tax resident individuals locals and foreigners who are in singapore for 183 days or more 2. Compute rental income for tax resident and non resident individuals.

A personal income tax guide for foreigners in singapore singapore tax filing calendar disclaimer. Each income tax calculator allows for employment income expenses divided business and personal activity everything you will require to calculate your income tax return for 2020 21. Sign up now for the latest page updates and to be part of the 2020 2021 tax win zone. The remaining amount 5 000 366 25 will be used to offset his income tax payable in subsequent years until the rebate has been fully utilised.

.jpg)