Short Term Investment Malaysia

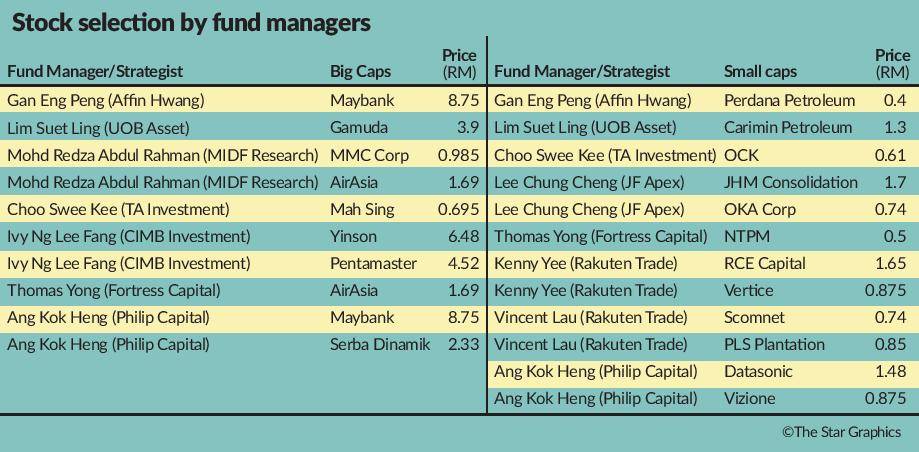

This can lead to high investment costs due to various brokerage and transaction fees.

Short term investment malaysia. Thinks they found a hidden gem investment that is both 1 high profit and 2 easy. Popular as a long term investment. Hard mode property. This involves obtaining a 100 or more bank loan then immediately renting.

However risk in this category is given a sense of reassurance due to the ever appreciating value of property that malaysia has seen thus far. Also note that fixed deposits in malaysia are covered for up to rm 250 000 source. You ll sacrifice a potentially higher return for the safety of having the money. If you have a longer time horizon at least.

Profit margins up to 60. Join our 1 430 000 member network today. Myr 25 k 80 mn. Brokerage firms generally charge 0 05 to 0 5 in transaction fees with a minimum fee of around rm7 to rm12.

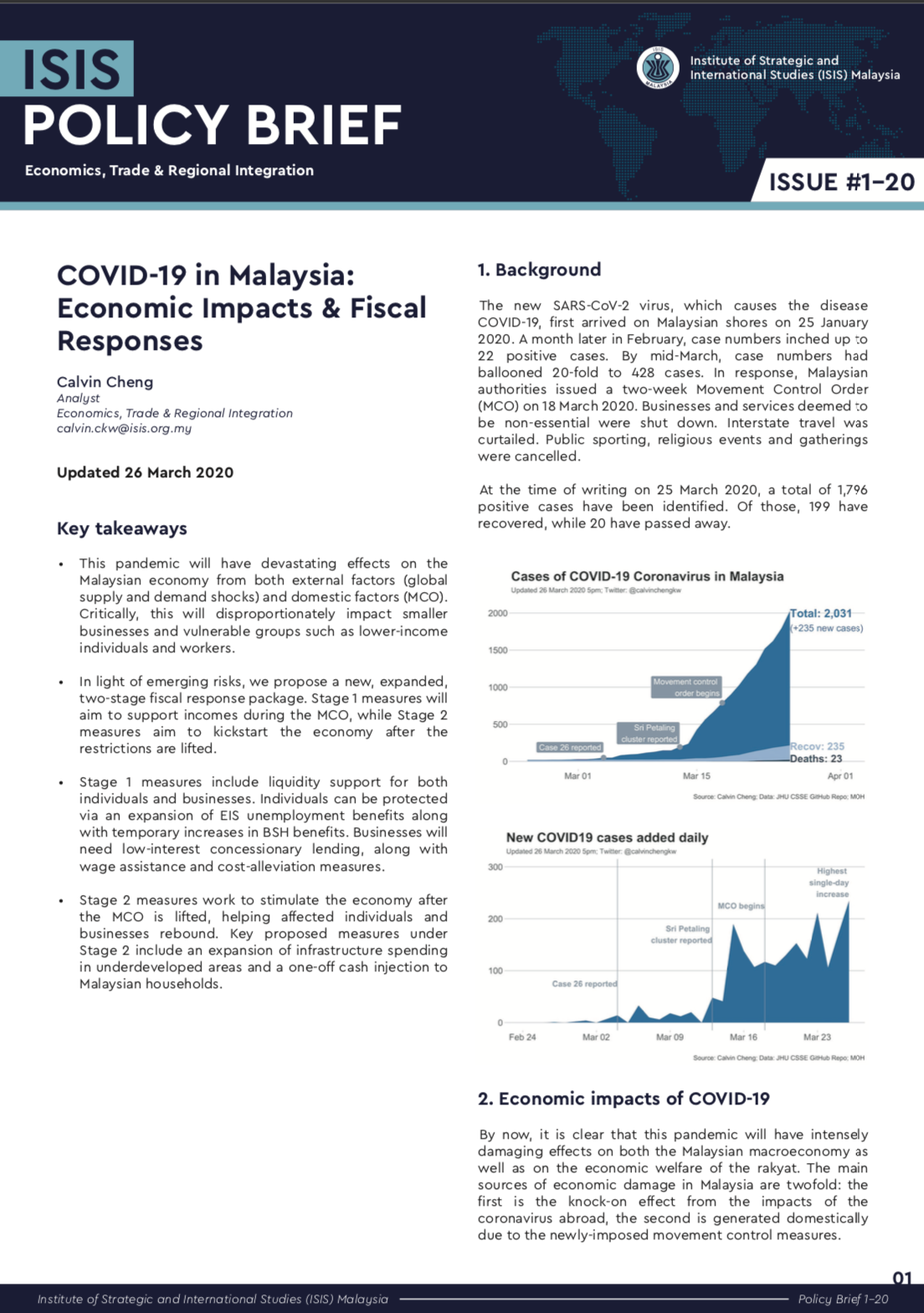

The typical short term investment is expected to grow for several months to a few years and can be turned into cash or other short term investments once they reach maturity. You should also avoid making small short term transactions with stocks. Perbadanan insurans deposit malaysia making it a low risk investment option offering steady returns. We have developed this package for the intraday or contra day trader to deliver them the short term gain by avoiding the risk of fluctuations in the market.

The larger your investment capital becomes coherently so do your risks and return of investments. That said fixed deposits still operate below inflation so if you want to grow your wealth considerably it may not be the best option. Not impossible but highly stressful. Defining traits of people who invest in this investment vehicle.

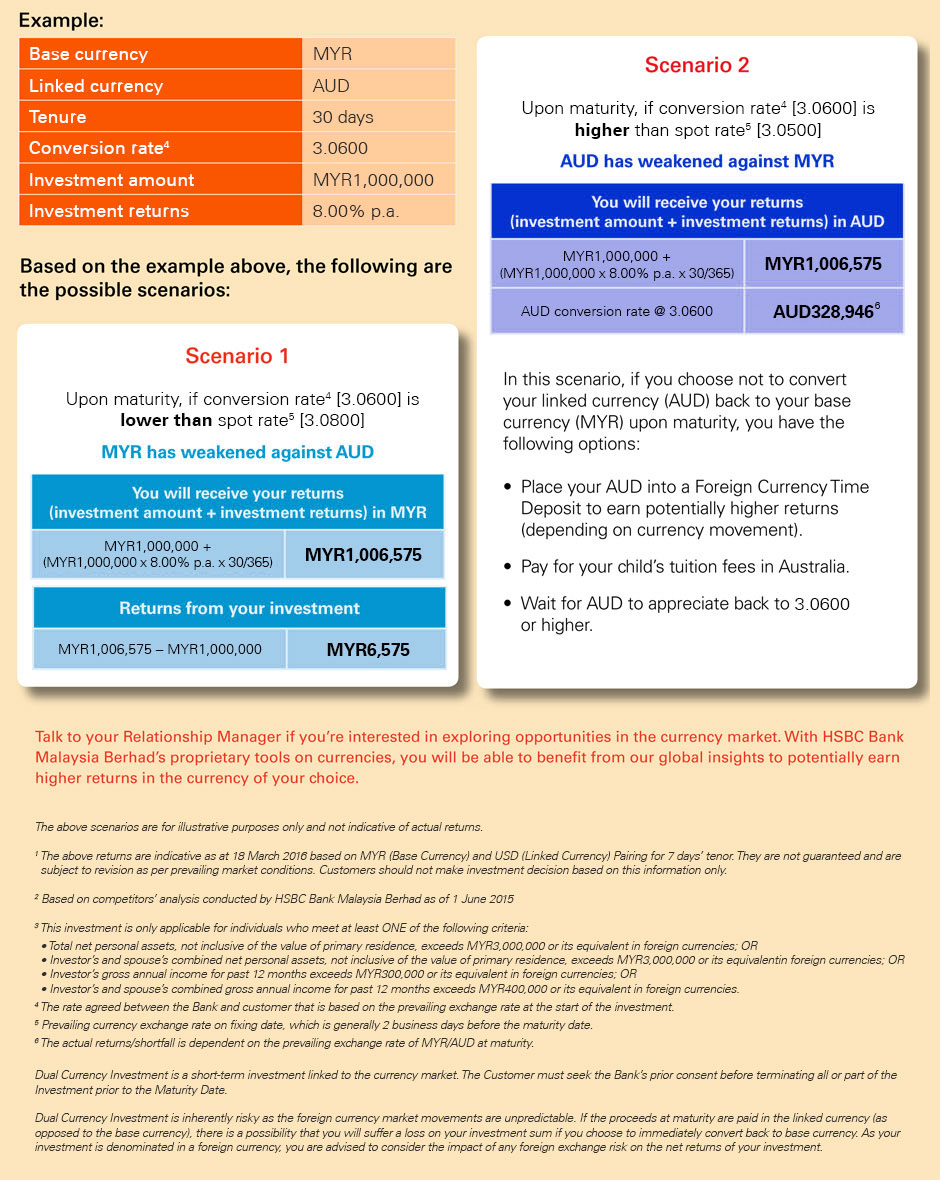

60 business investment opportunities in malaysia. Invest in a business in malaysia and 176 countries 950 industries. In the investing world long term investments are really long term often decades which leaves room for short term investments that can still last several years. Favoured by people who like short term investments.

Bonds are mainly for medium to long term investment not for short term speculation. I asked hard questions to the ceo of funding societies malaysia 12 skim cepat kaya get rich quick schemes. You could lose part or all of your investment if you choose to sell bonds prior to maturity. You should be prepared to invest your funds in bonds for the full investment tenor.

Short term investments are those you make for less than three years.

-3.jpg)

.jpg.aspx)