Share Margin Financing Malaysia

From as low as br 1 15 p a.

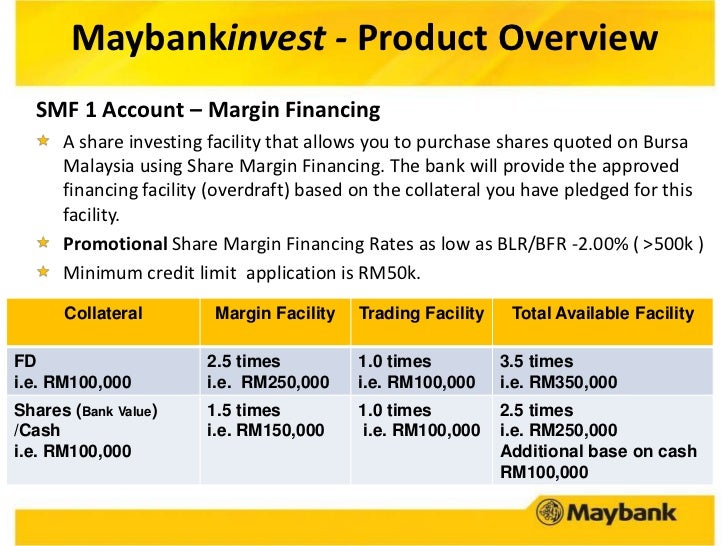

Share margin financing malaysia. Start from a minimum rm5 000 and get your investment growing. Share financing offers competitive interest rates so you will save on interest while boosting your investment potentials. This provides you increased financial support to take advantage of investment opportunities identified. In malaysia share margin financing can be provided by conventional banks stock brokers or investment banks.

Share margin financing is a convenient facility offered to traders seeking to expand their trading potential. All you need to do is to place either cash or shares as collateral for the credit facility applied. Share margin financing is a credit facility granted to individuals and corporations to finance the purchase of shares listed on bursa malaysia. Above all make sure to always practice caution and do not over leverage when using financing to make investments in the stock market.

Clients can use share margin financing as additional funding for the purchase of shares quoted or to be quoted on bursa malaysia. With hong leong s latest smf two 88 promotion you can now further finance your share purchasing with a fixed interest rate of 2 88 p a. However it isn t immensely difficult to understand and even less difficult to get. It is available to all eligible malaysians residents and non residents who are of good financial standing.

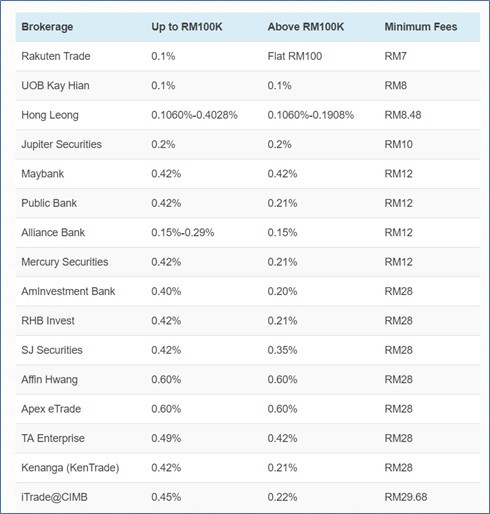

Check share margin financing plans smf plans in malaysia and choose the best option that suits your investing needs. For the first three months. Share margin financing smf is a standby revolving personal lending facility secured by collaterals for the trading of shares on bursa malaysia. Apply for best share margin financing plans at loanstreet now.