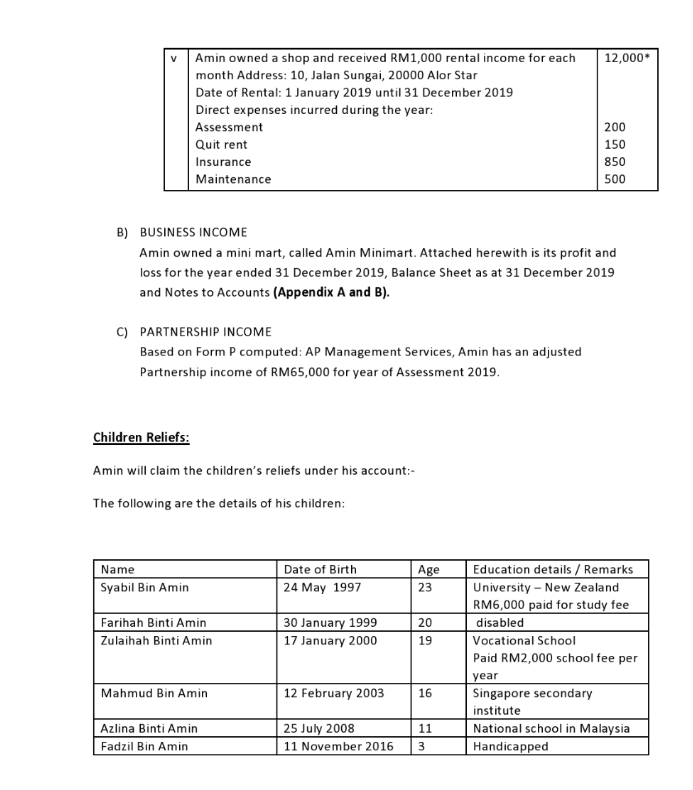

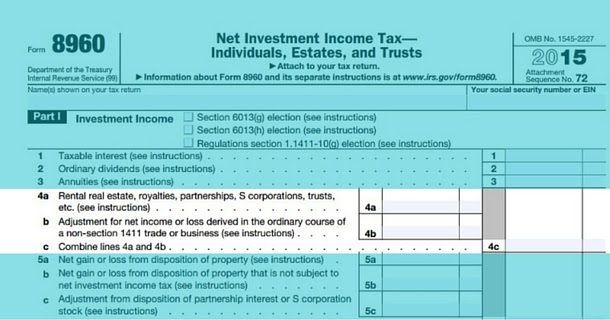

Section 4d Rental Income Tax Computation

Income received from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ita.

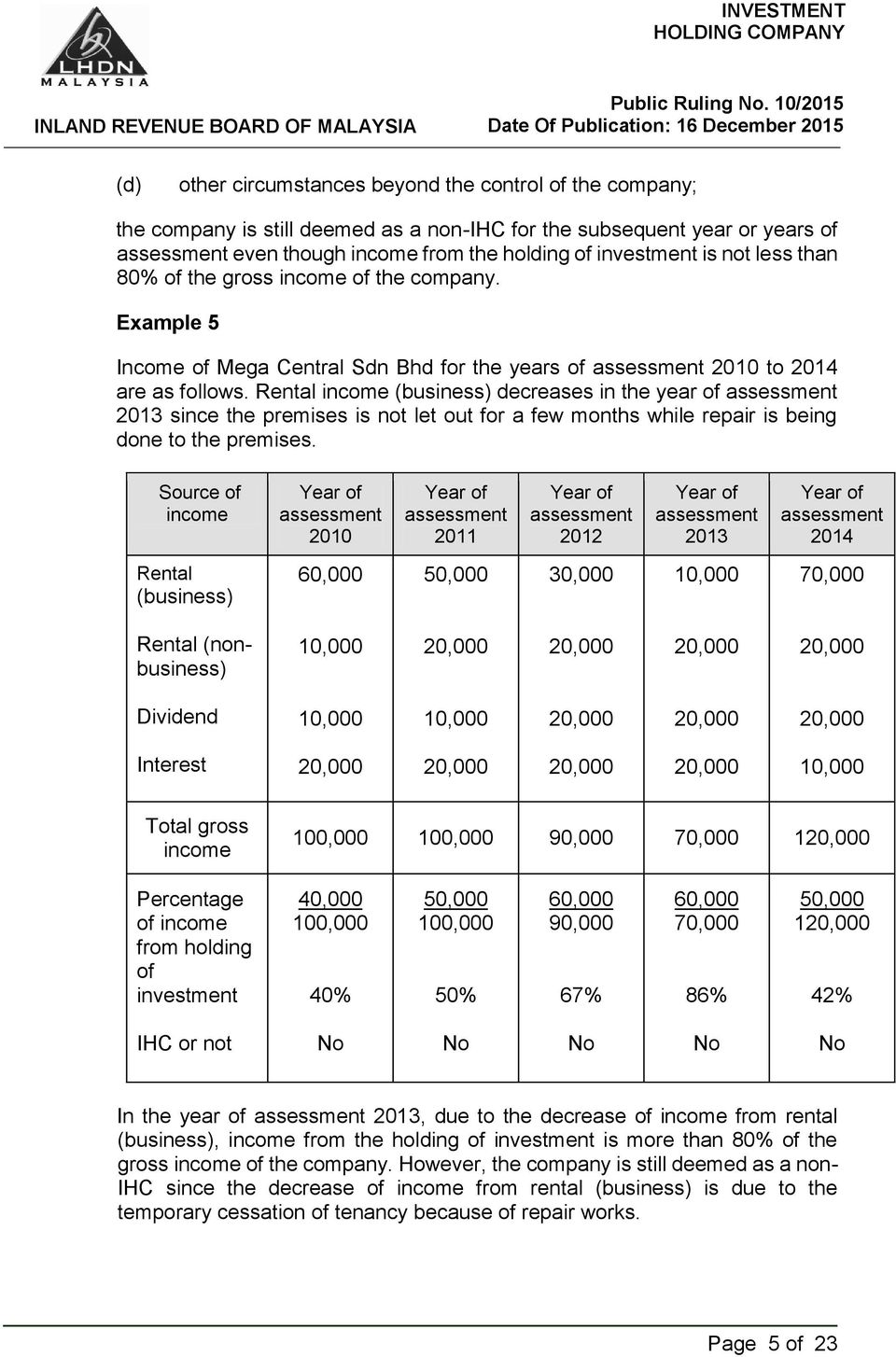

Section 4d rental income tax computation. 2 1 rent or rental income or income from letting includes any sum paid for the use or occupation of any property or part thereof including premiums and. Income tax return and either doesn t file such a return or files only to get a refund of withheld income tax or estimated tax paid. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Tax planning on rental income from letting of real property.

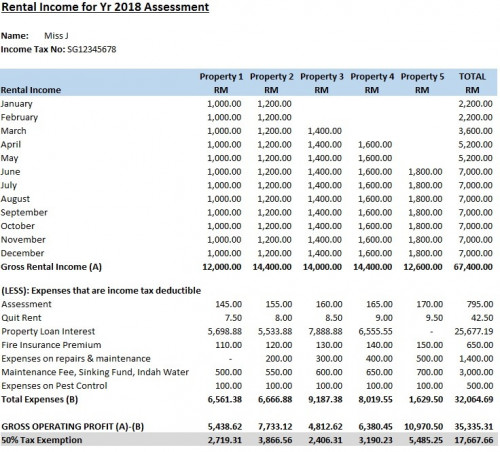

Azrie owns 2 units of apartment and lets out those units to 2 tenants. When less than 100 of your property is being rented out then you may only deduct a portion of your rental related expenses. When schedule e is used to calculate qualifying rental income the lender must add back any listed depreciation interest homeowners association dues taxes or insurance expenses to the borrower s cash flow. From the computation below rental income with trading loss can be set off against net rental income and enjoy a lower tax payable.

When computing the rental gain to be disclosed in tax filings the gross rental income can. The tenants are entitled to use the swimming pool tennis court and other facilities that are provided in the apartment. For the purpose of this ruling the words used have the following meanings. Rental income is assessed on a net basis.

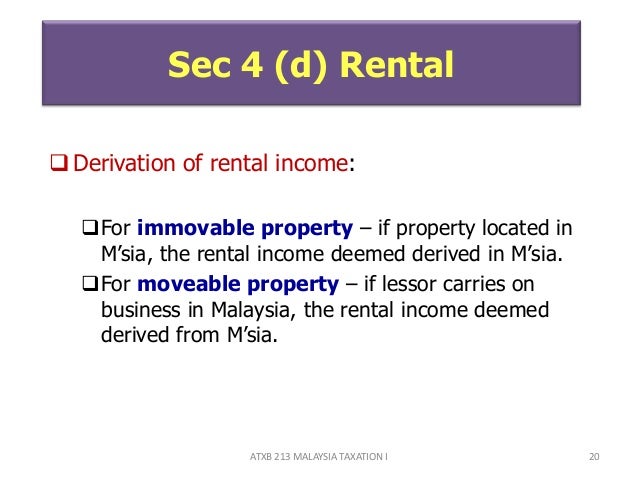

501 for details and examples. The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967. The method for calculating rental income or loss for qualifying purposes is dependent upon the documentation that is being used.

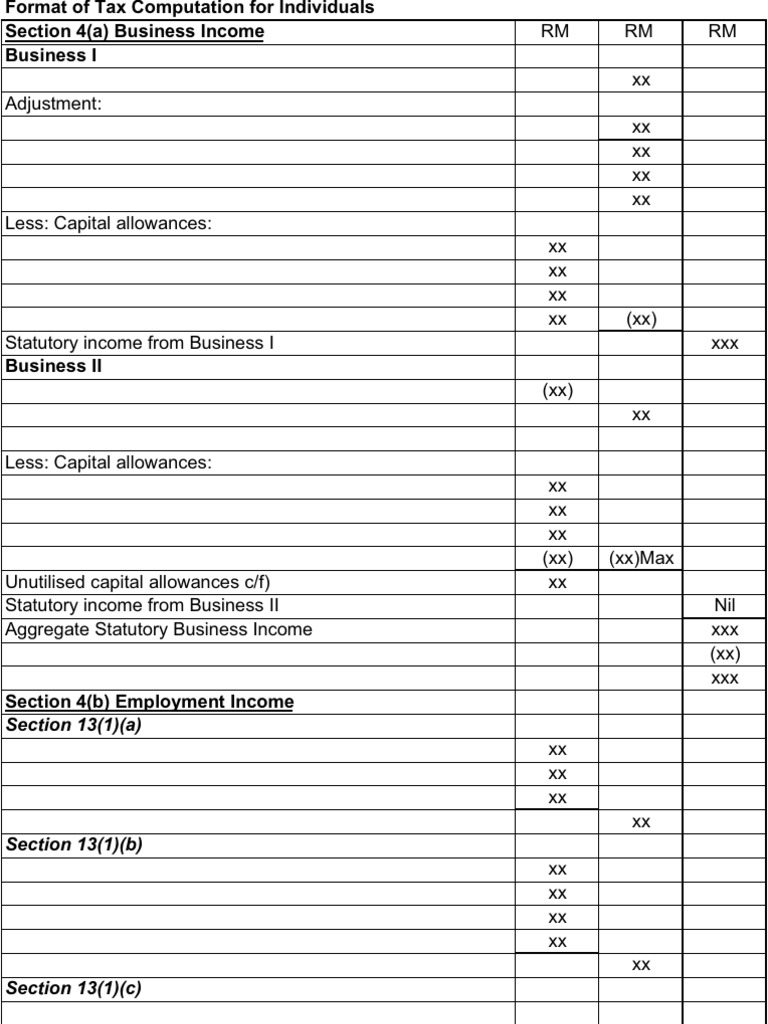

For this purpose a person isn t a taxpayer if he or she isn t required to file a u s. Rental income is subject to income tax. Computing the statutory income under section 4 d of the act. Who wasn t a qualifying child see step 1 of any taxpayer for 2019.

This means that any profit or net amount left once you have added together your rental income and deducted any allowable expenses is taxable. S 4 d rental income letting of real property as a non business source under paragraph 4 d of ita. This was introduced in section 4 d of the income tax act 1967 ita. Your property is still subject to property tax which can be calculated by multiplying the annual value av of the property to the applicable property tax rate.

Federal income tax returns schedule e.