Section 127 Income Tax

20 1996 110 stat.

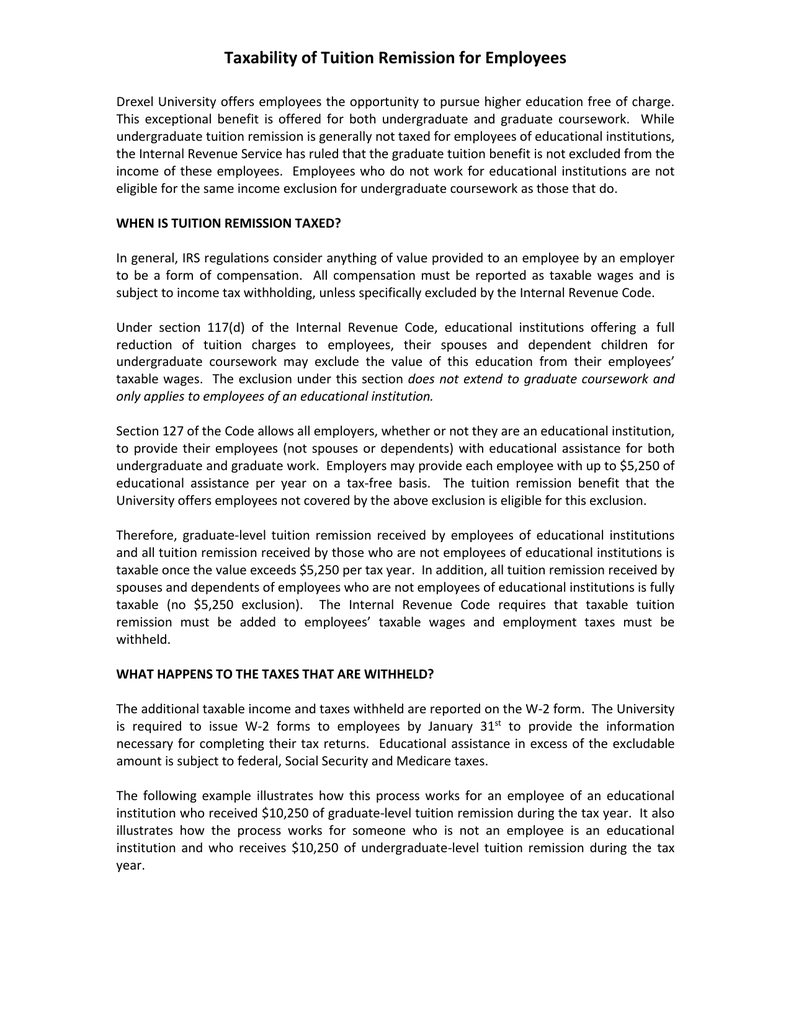

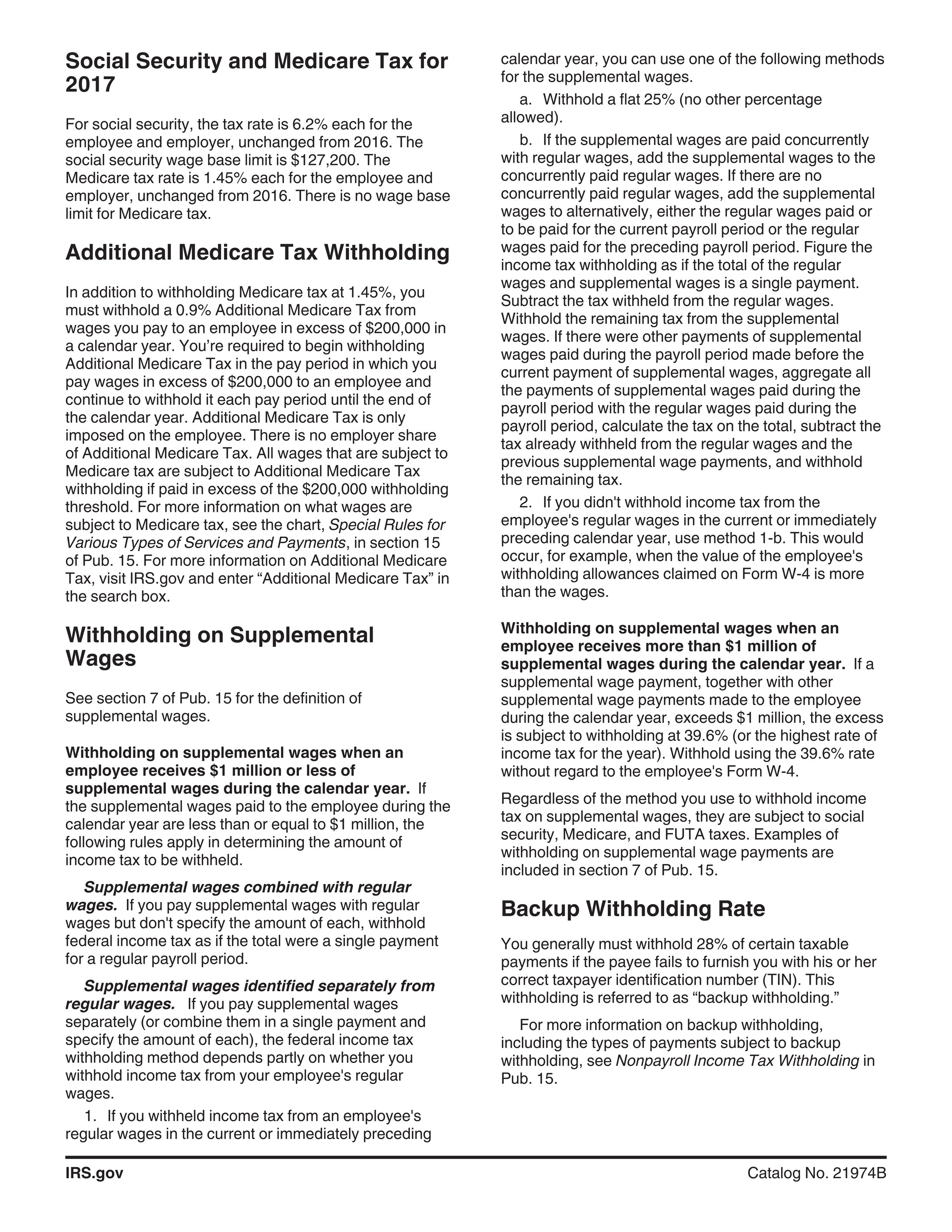

Section 127 income tax. Appeal to the commissioner appeals. A benefit an employer provides on behalf of an employee is taxable to the employee even if. More than one irc section may apply to the same benefit. Amounts for additional education expenses exceeding 5 250 may be excluded from tax under irc section 132 d.

1 any person dissatisfied with any order passed by a commissioner or a taxation officer under section 121 122 143 144 162 170 182 183 184 185 186 187 188 or 189 or an order under sub section 1 of section 161 holding a person to be personally liable to pay an amount of tax or an order under clause f of sub section 3 of section 172 declaring substituted for treating by finance act 2003 a person to be the. Section 127 in the income tax act 1995 127. The secretary of the treasury shall establish expedited procedures for the refund of any overpayment of taxes imposed by the internal revenue code of 1986 which is attributable to amounts excluded from gross income during 1995 or 1996 under section 127 of such code including procedures waiving the requirement that an employer obtain an employee s signature where the employer demonstrates to the satisfaction of the secretary that any refund collected by the employer on behalf of the. Section 127 of the income tax act 1961 act for short deals with the power of competent officers to transfer cases.

Expatriate posts based on the requirements of the ipc rdc. For example education expenses up to 5 250 may be excluded from tax under irc section 127. The secretary of the treasury shall establish expedited procedures for the refund of any overpayment of taxes imposed by the internal revenue code of 1986 which is attributable to amounts excluded from gross income during 1995 or 1996 under section 127 of such code including procedures waiving the requirement that an employer obtain an employee s signature where the employer demonstrates to the. There will also be a layak menuntut insentif dibawah seksyen 127 which refers to claiming incentives under section 127 of the income tax act ita 1976.

This is incentives such as exemptions under the provision of paragraph 127 3 b or subsection 127 3a of ita 1976 which is claimable as per government gazette or with a minister s approval letter. Tax exemption of statutory income for 10 years under section 127 of the income tax act 1967 act 53 dividends paid from the exempt income will be exempted from tax in the hands of its shareholders ii an approved ipc rdc status company will enjoy the following benefits. 1 power to transfer cases 2 999999. 104 188 title i 1202 c 3 aug.