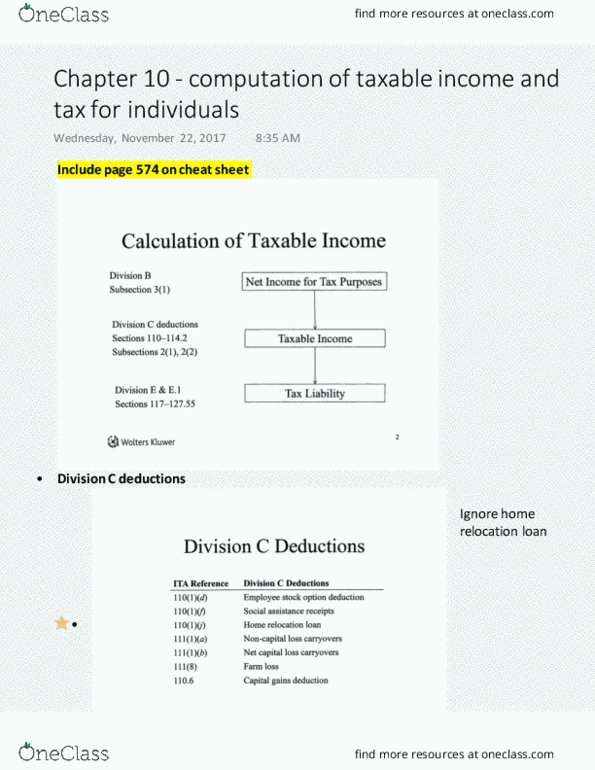

Section 110 Tax Deduction

An employer who in any calendar year pays to an employee cash remuneration to which paragraph 7 b of section 3121 a is applicable may deduct an amount equivalent to such tax from any such payment of remuneration even though at the time of.

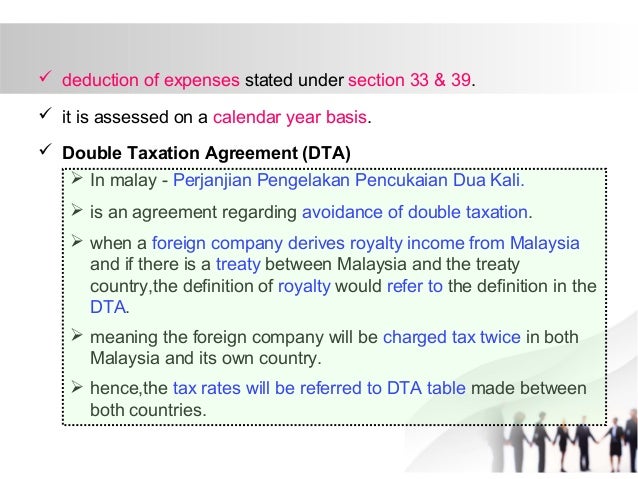

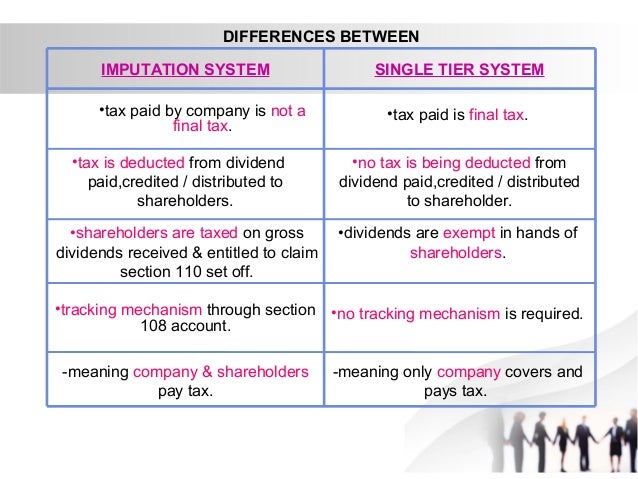

Section 110 tax deduction. The employee has not disposed of the shares otherwise than as a result of the employee s death or exchanged the share within two years after the date the taxpayer acquired them. The rate of tax depends on the individual s resident status which is determined by the duration of his stay in the country as stipulated under section 7 of the income tax act 1967. A in the case where section 40 applies dividend is paid to that person during the period from the date that person acquires the shares from which such dividend is. The tax imposed by section 3101 shall be collected by the employer of the taxpayer by deducting the amount of the tax from the wages as and when paid.

Tax deduction under section 110 others no. Provided that that person shall not be entitled to any set off under that section if. If section 110 does apply amounts received by the lessee in cash or as a rent reduction are not included in the lessee s income and the lessor is treated for tax purposes as the owner of the improvements constructed by the lessee with the proceeds of the construction allowance. 1 section 110 of the principal act prior to the amendment of that section under this act shall apply to a person other than an offshore company excluding chargeable offshore company in respect of any tax deducted under this part.

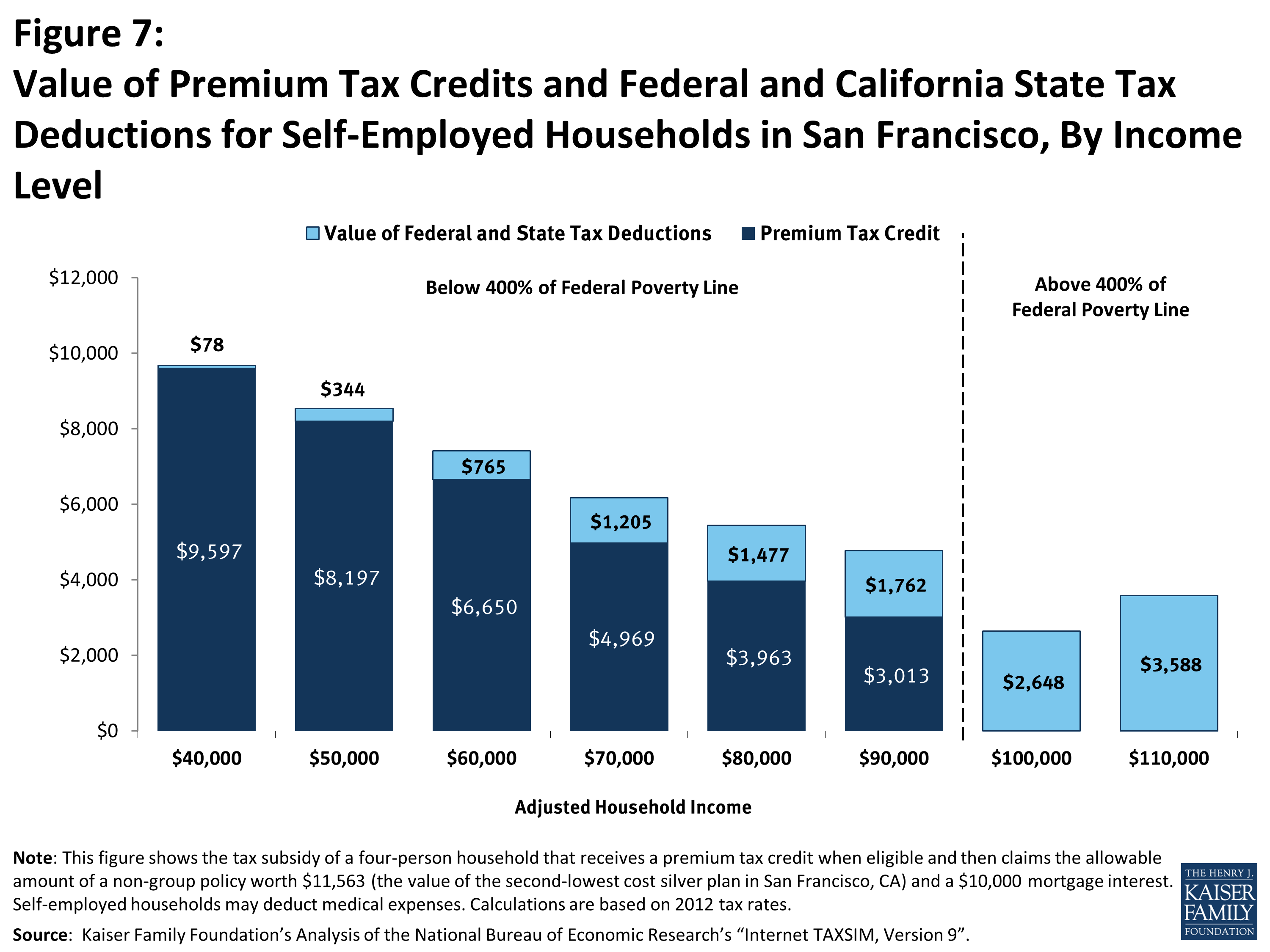

Code name of payer gross tax deducted date of receipt trust body income rm rm sen payment no. Section 110 of the current internal revenue code irc provides an interesting opportunity for commercial tenants and landlords alike. Ccpc shares disposed of in the year where the employee dealt at arm s length with the corporation. If the section 110 requirements are met there s no income recognized by the tenant to the extent the allowance is used to construct improvements since these improvements will revert to the landlord when the lease terminates.

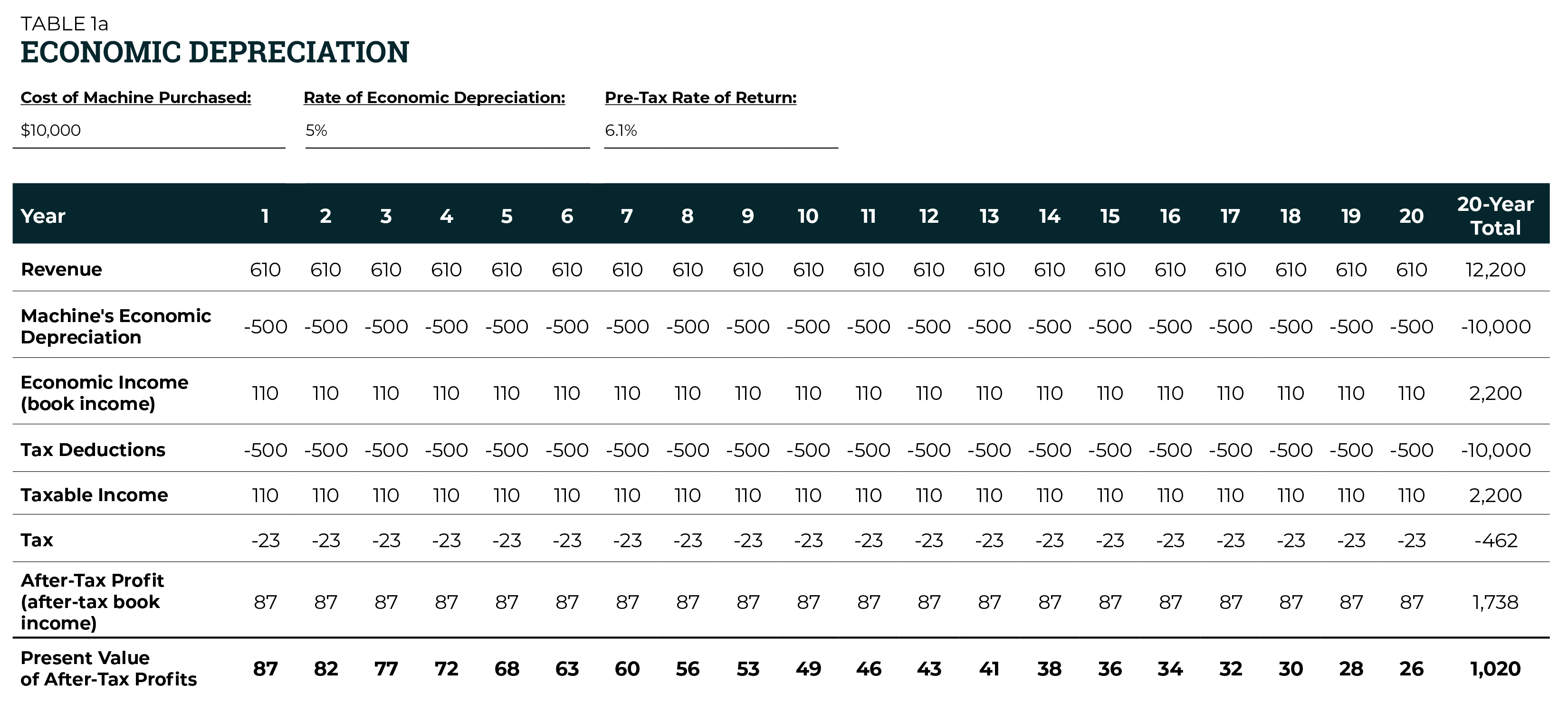

Total tax deducted under section 110 others c. In this case for depreciation purposes the landlord must treat these improvements as nonresidential real property. Year of assessment z 1 10 9 8 7 6 5 4 3 2 tot al b. In this case the employee can claim a deduction under paragraph 110 1 d 1 of the income tax act if all of the following conditions are met.

110 allows tenants to exclude from income any amount received in cash as a construction allowance from the owner or treated as a reduction in rent. Hk 3 tax deduction under section 51 of financial act 2007 dividends 11 hk 4 particulars of properties assets and total rental 13 hk 5 computation of statutory income from interest royalties 15 hk 6 tax deduction under section 110 others 16 hk 7 not applicable to form be not enclosed. Total gross royalty income income code 5. This safe harbor exclusion applies if the allowance is.