Sdn Bhd Tax Rate 2019

How does monthly tax deduction mtd pcb work in malaysia.

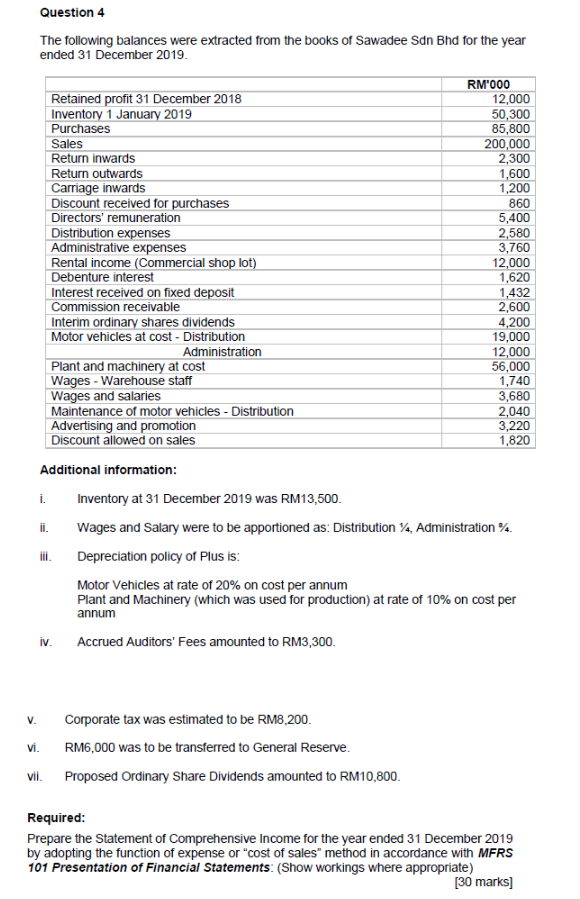

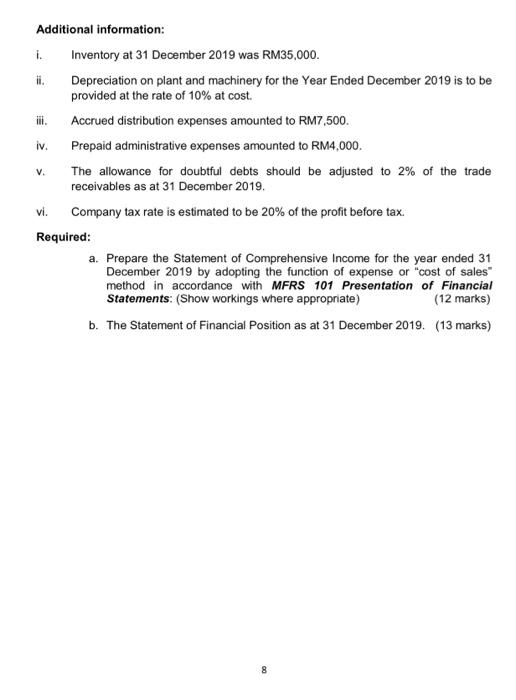

Sdn bhd tax rate 2019. Malaysia corporate income tax rate. Calculations rm rate tax rm 0 5 000. On the first 5 000 next 15 000. On subsequent chargeable income 24.

This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. Malaysia income tax e filing guide. Company with paid up capital more than rm2 5 million. This page is also available in.

How to pay income. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. Home tax rate of company. On the first 2 500.

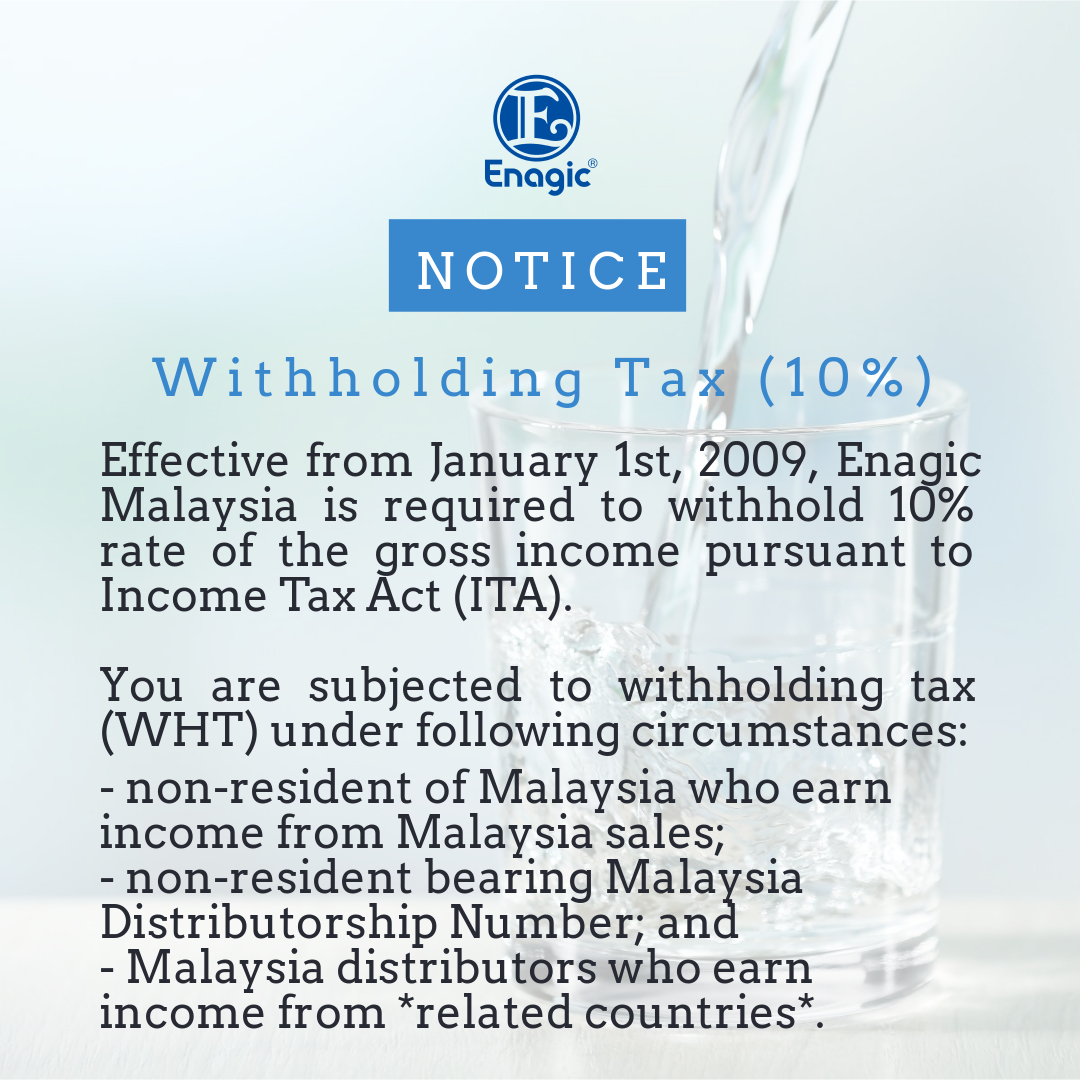

Company with paid up capital not more than rm2 5 million. The fixed income tax rate for nonresident individuals is also increased to 30 percent. 2019 2020 malaysian tax booklet this publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. Company with paid up capital not more than rm2 5 million on first rm500 000 subsequent balance.

What is income tax return. Resident company with paid up capital of rm2 5 million and below at the beginning of the basis period sme note 1 on first rm500 000 chargeable income 17. One of the key proposals in this year s budget is the increase in individual income tax rate highest band from 28 percent to 30 percent for resident individuals with chargeable income of more than myr 2 000 000. 2019 05 30 14 53 56 ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor.

Yet you both have the same marginal tax rate of 22. What is tax rebate. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Your effective tax rate would be 14 9 or 8 989 divided by 60 000.

Year assessment 2017 2018.