Sales Service Tax Malaysia 2018

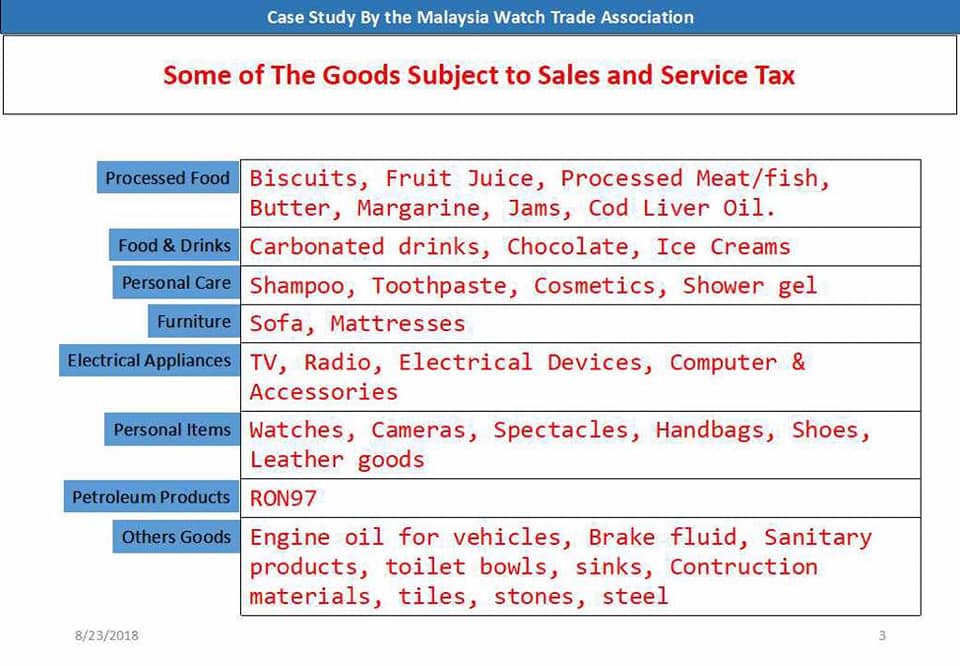

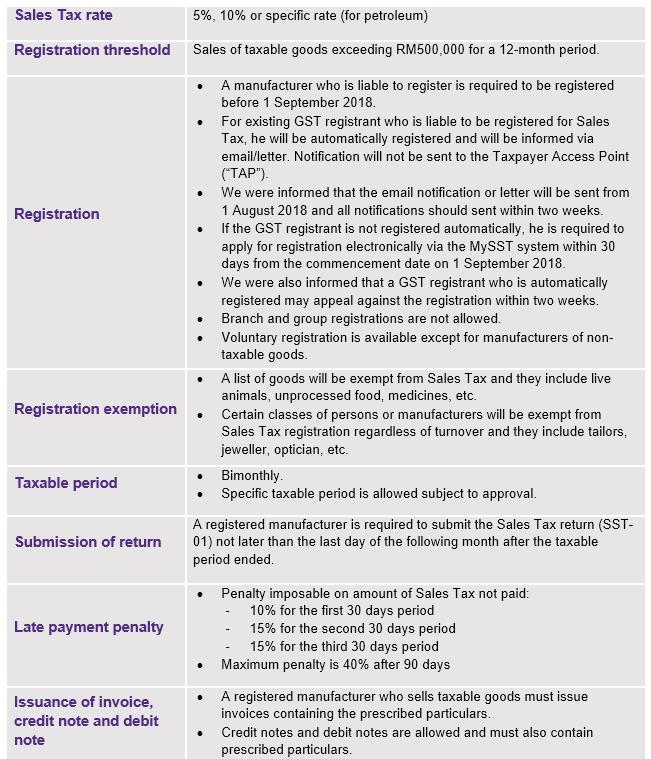

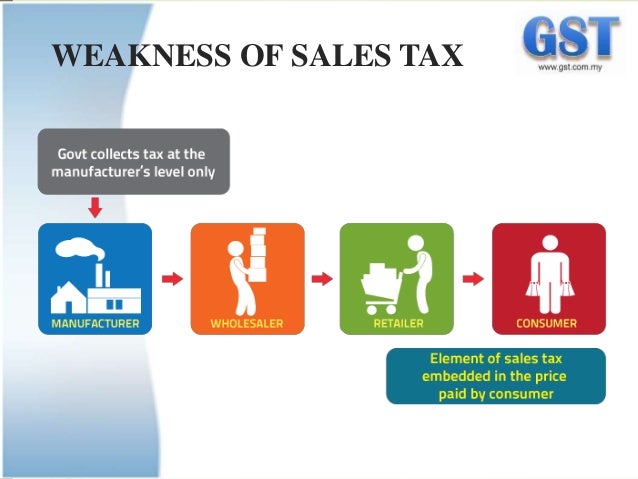

I the sst will be a single stage tax where the sales ad valorem tax is charged upon taxable goods manufactured and sold by a taxable person in malaysia and taxable goods imported into malaysia.

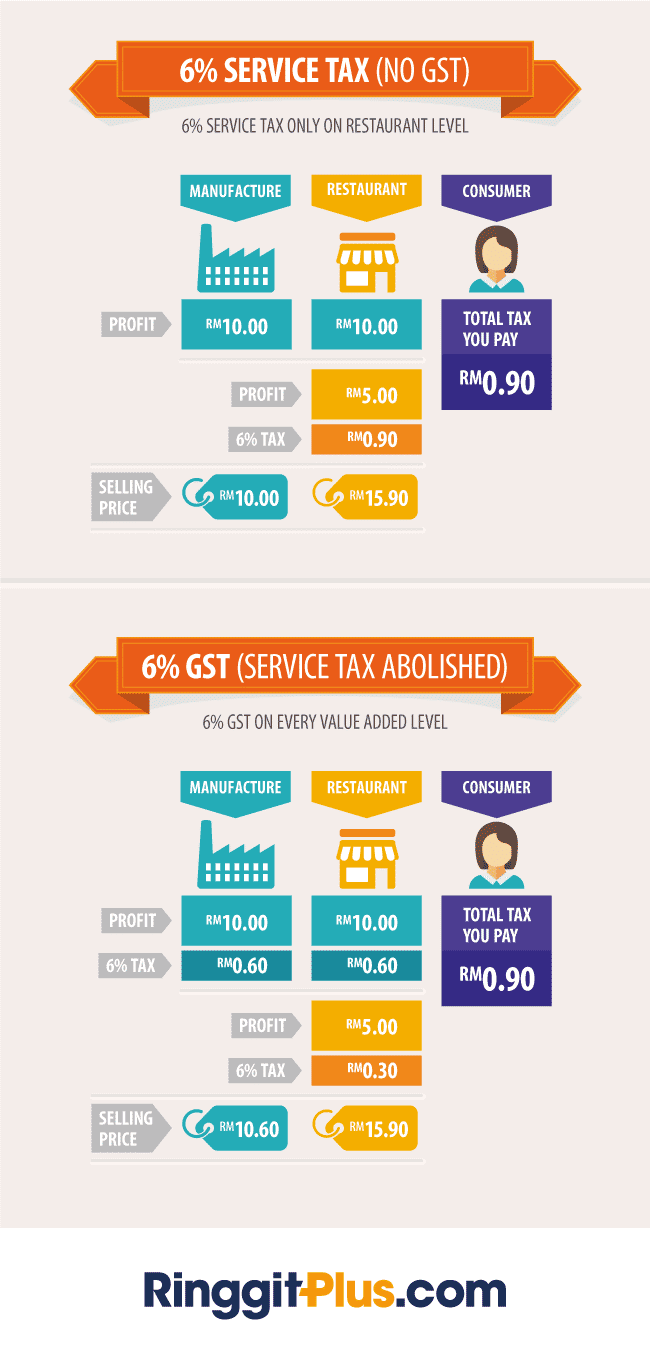

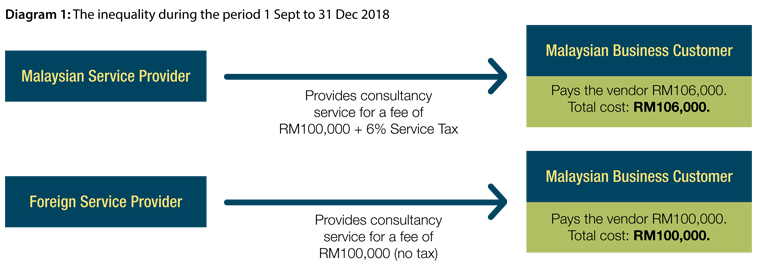

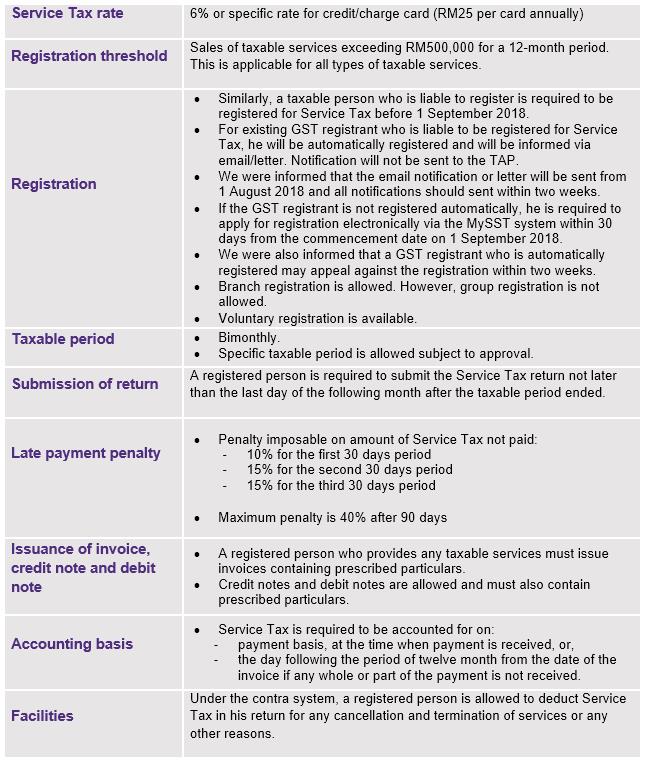

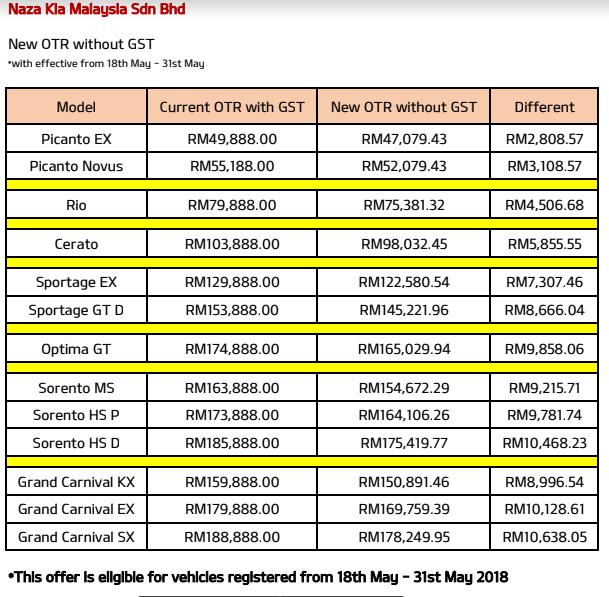

Sales service tax malaysia 2018. Jabatan kastam diraja malaysia. The move of scrapping the 6 gst has paved the way for the re introduction of sst 2 0 which will come into effect in 1 september 2018. The rate of service tax is fixed under the service tax rate of tax order 2018 and comes into force on 1 september 2018. Rate of service tax for credit and charge cards.

Meanwhile the balance of the work completed on 15 october 2018 shall be charged with sales tax at 10. The rate of service tax is 6 of the price or premium for insurance policy value of betting and gaming etc. What is the treatment for importation of big ticket items for upstream petroleum activities. Sales services tax 2018 kalendar.

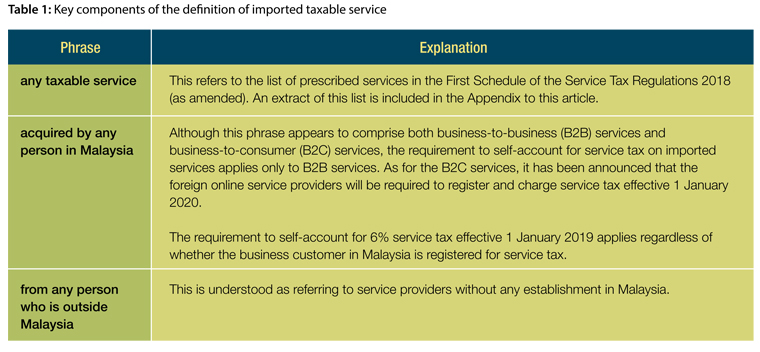

Malaysia is to reintroduce its sales and services taxes sst from 1 september 2018 with a likely standard rate of 10. From 1 september 2018 the sales and services tax sst will replace the goods and services tax gst in malaysia. Sales tax regulations 2018. The taxable services are as follows.

Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline. Gst is charged at standard rate of 0 on the part of work performed until 31 august 2018. Service tax regulations 2018. Service tax 19 7 2018 11 03.

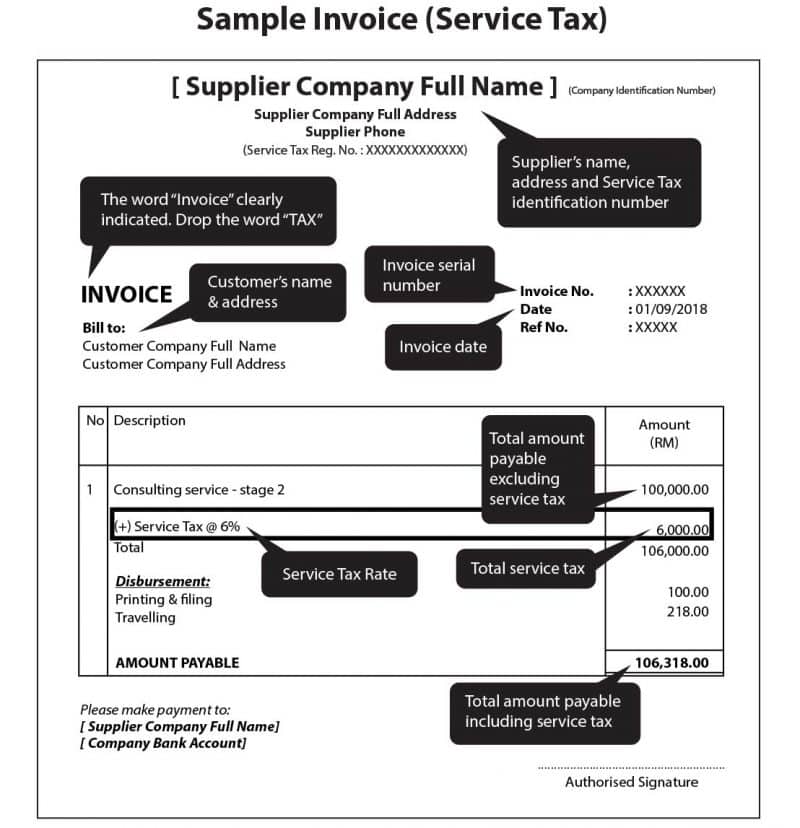

The ministry of finance mof announced that sales and service tax sst which administered by the royal malaysian customs department rmcd will come into effect in malaysia on 1 september 2018. Of the taxable service as determined under section 9 of sta 2018. Malaysia sales tax 2018 following the announcement of the re introduction of sales and services tax sst that will kick start on 1 september 2018 the royal malaysian customs department rmcd has recently announced the implementation framework of sst as well as a detailed faqs to arm malaysians with sufficient knowledge of the new tax regime before sst commence. Here are the details on how the sst works the registration process returns and payment of the sst and the transitional measures to take after the abolishment of the gst.