Salary Calculator Malaysia 2018

If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582.

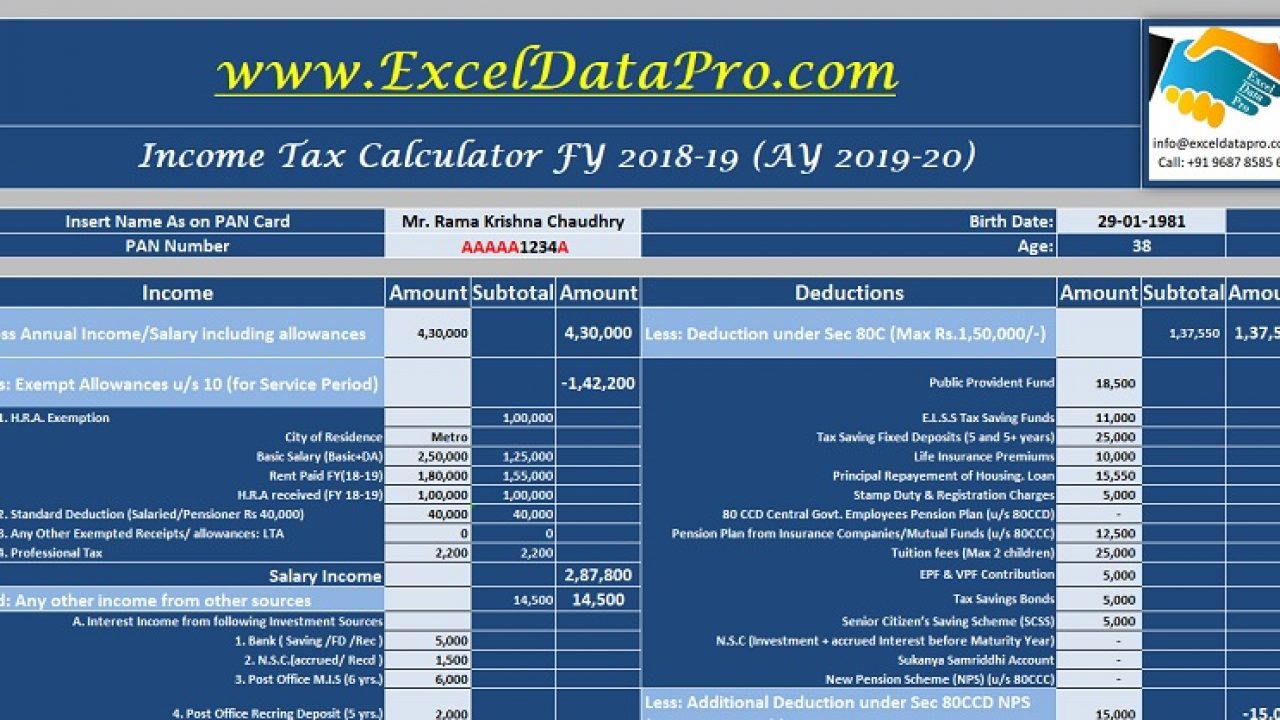

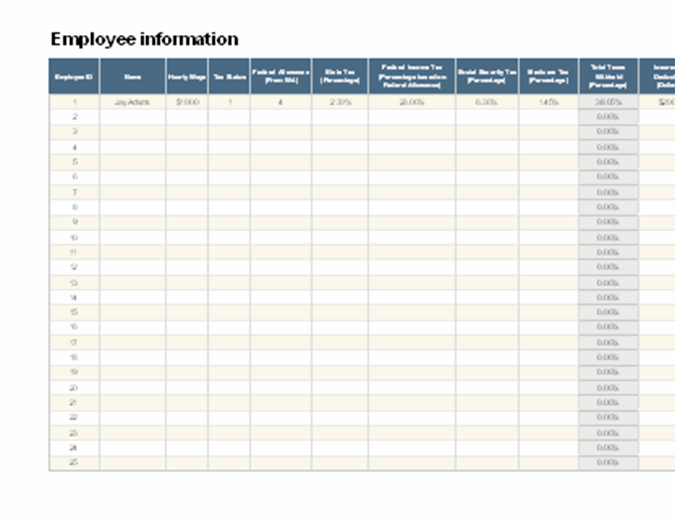

Salary calculator malaysia 2018. The annual wage calculator is updated with the latest income tax rates in malaysia for 2019 and is a great calculator for working out your income tax and salary after tax based on a annual income. Epf contributions tax relief up to rm4 000 this is already taken into consideration by the salary calculator life insurance premiums and takaful relief up to rm3 000. Epf contribution third schedule. Update of pcb calculator for ya2018.

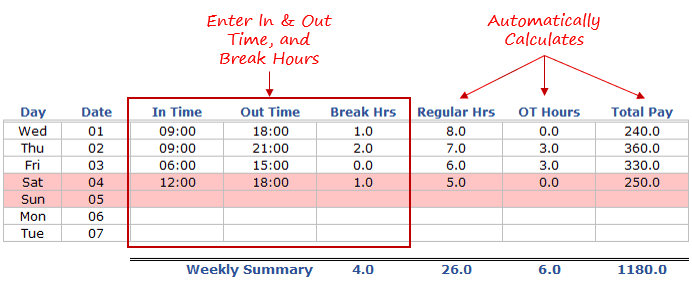

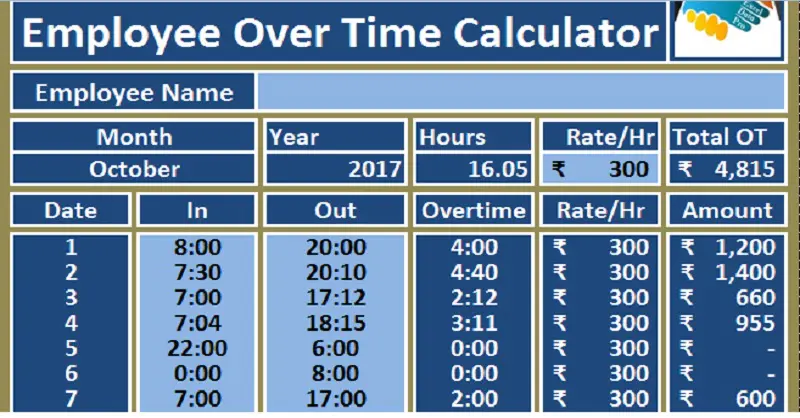

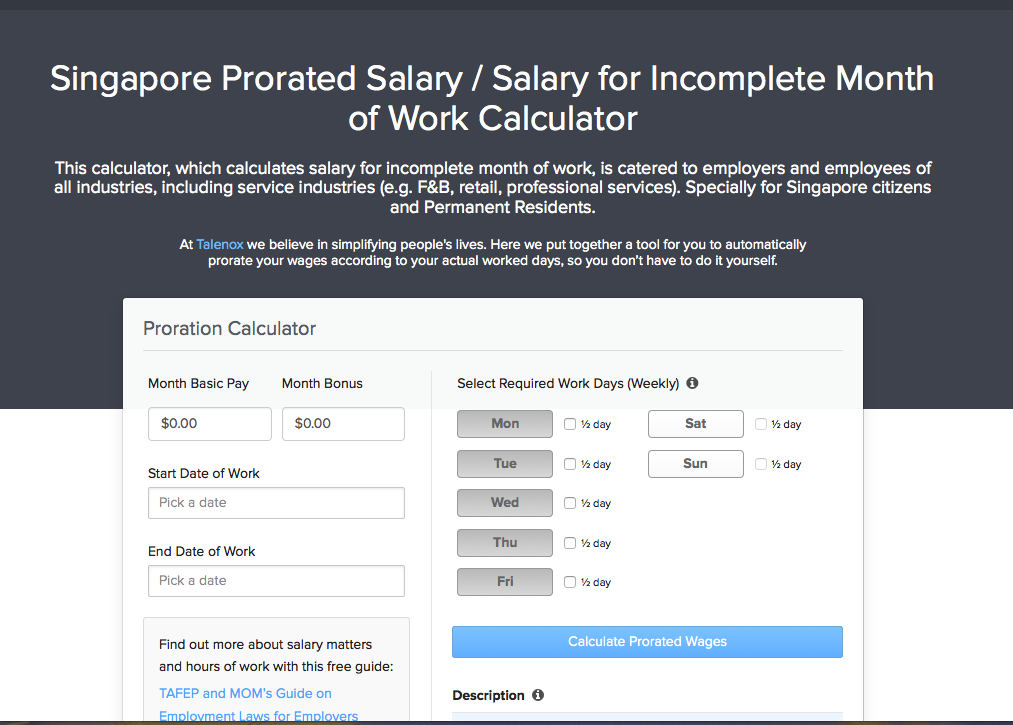

With a separate assessment both husband. A free calculator to convert a salary between its hourly biweekly monthly and annual amounts. Monthly salary x number of days employed in the month number of days in the respective month. Experiment with other financial calculators or explore hundreds of individual calculators covering other topics such as math fitness health and many more.

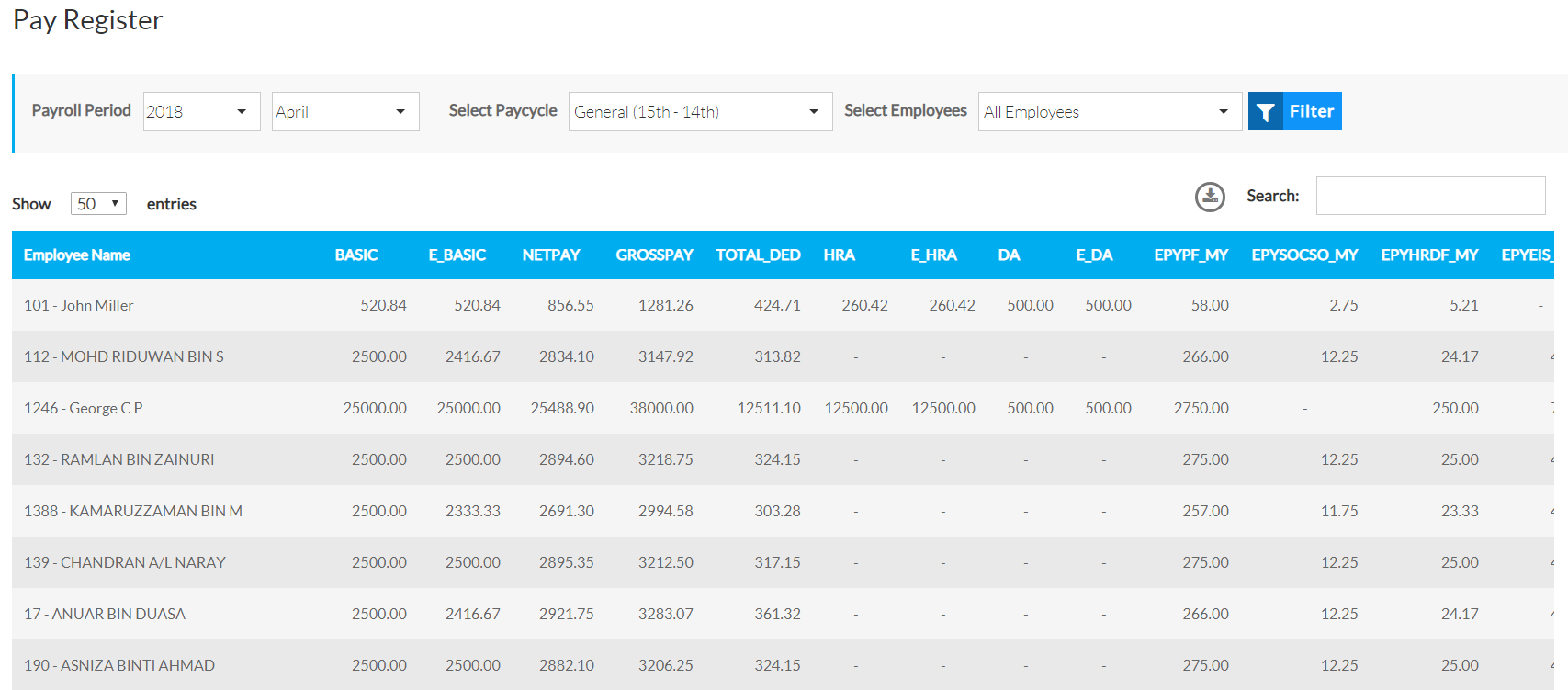

Examples of allowable deduction are. Monthly tax deduction pcb and payroll calculator tips calculator based on malaysian income tax rates for 2019. The calculations is base on the number of days in a month. Salary for january 2016 rm 1000 x 20 31 rm 645 16.

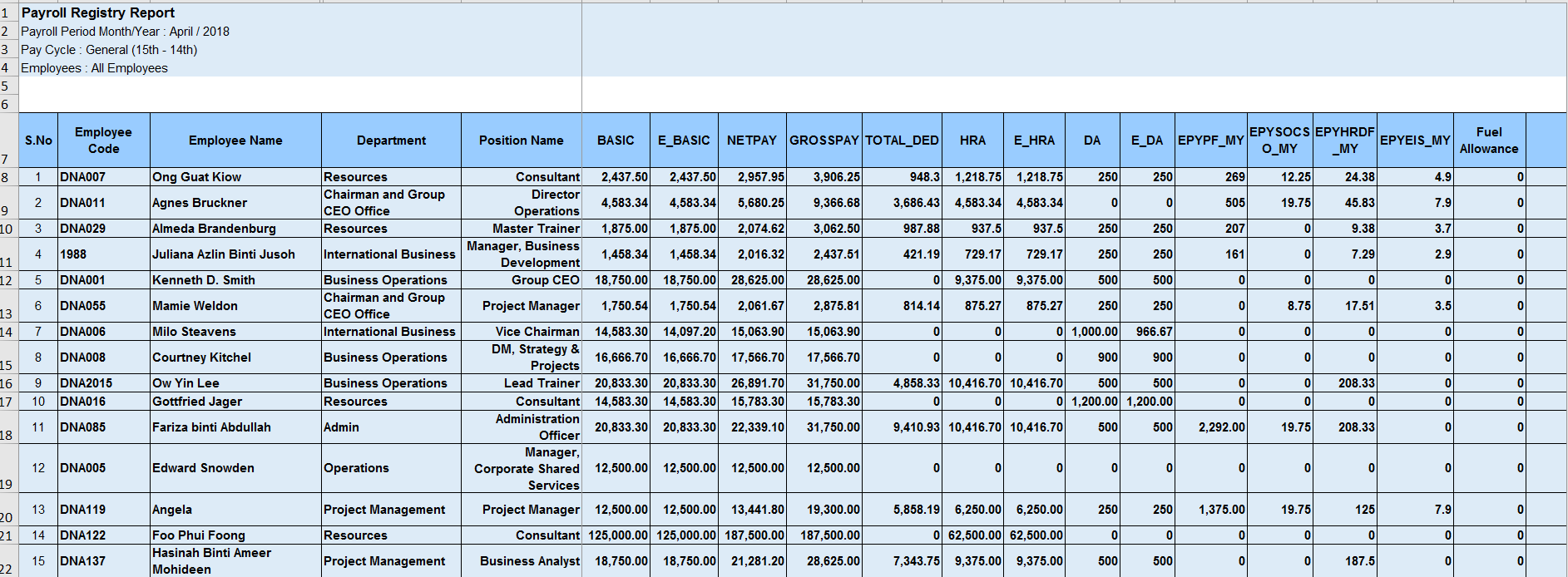

Finish your monthly payroll calculations in minutes with 3 simple steps. Actpay is targeted at malaysian sme s. This ease of use and accuracy makes actpay an excellent payroll software for for small and medium businesses in malaysia. Sip eis table.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Living wage series malaysia january 2018 in malaysian ringgit per month living wages wages in context malaysia the living wage is based on the concept that work should provide an adequate income to cover the necessary living costs of a family. Employee starts work on 12 1 2016 his salary is rm 1000. The calculator is designed to be used online with mobile desktop and tablet devices.

Under the minimum wages order amendment 2018 effective 1st january 2019 the minimum wages is rm1 100 per month should be paid to an employee who is paid monthly and rm5 29 per hour for an employee who is paid hourly including sabah and sarawak. Introduced pcb schedule mode where pcb amount will match lhdn pcb schedule. A simplified payroll calculator to calculate your scheduled monthly tax deduction aka potongan cukai berjadual. That means that your net pay will be rm 59 418 per year or rm 4 952 per month.

Adjustments are made for holiday and vacation days. Employment insurance scheme eis deduction added. Eis is not included in tax relief. Official jadual pcb 2018 link updated.

Your average tax rate is 15 12 and your marginal tax rate is 22 50. Review the full instructions for using the malaysia salary after tax calculators which details malaysia tax. 8 epf contribution removed. Jadual pcb 2020 pcb table 2018.

What is minimum wage in salary calculator. It is not based on the number of working days in the month.