Rpgt Rate Malaysia 2019

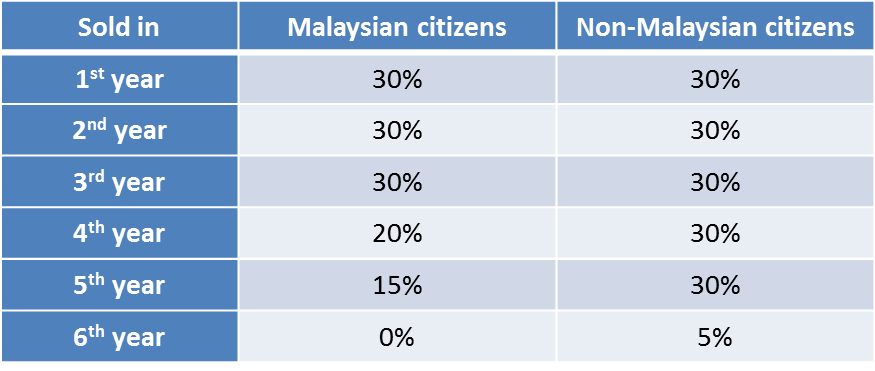

Rpgt rates 2019 citizens non citizens company.

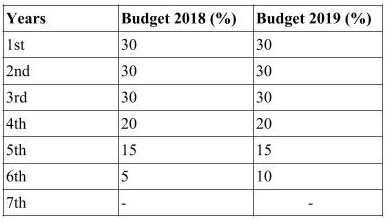

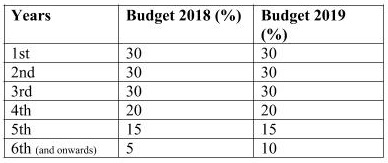

Rpgt rate malaysia 2019. Rm15000 rm7500 rm7500 saving that s a. Real property gains tax ckht. From 1st of january 2019 onwards the rpgt rates are as below for individuals who are citizens or permanent residents of malaysia. Companies trustee 1 individuals individuals 2 and executor of deceased estate 2 companies 2 within 3 years.

Latest 2019 rpgt rates in malaysia 5 hike since 2019 is malaysian entitled for rpgt exemption. Real property gains tax rpgt is a form of capital gains tax that homeowners and businesses have to pay when disposing of their property in malaysia. In the 6 th and subsequent years. However a real property gains tax rpgt has been introduced in 2010.

Yes for malaysian it is a once in a lifetime so you must not have applied before this or it could also mean for first time seller but only for residential property disposal. Sistem percukaian negara alami perubahan utusan malaysia 11 july 2019 income tax collection vital for the malaysia we love the malaysian reserve 22 july 2019 lhdnm tawar program khas pengakuan cukai secara sukarela sinar harian 16 september 2019 jangan takut buat pengakuan cukai secara sukarela. There is no capital gains tax for equities in malaysia. In the 5 th year.

Rm650 000 rm500 000 based on market price on 1st january 2013 rm150 000. Find out how much you will be taxed when you sell your property in malaysia using our online rpgt calculator a k a. See the tables below for the tax rates. Lhdnm sinar harian 19 september 2019.

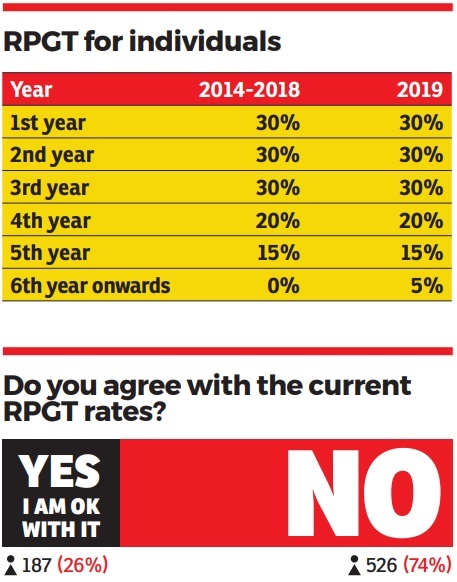

Rpgt rm150 000 x 5 rpgt rate for 6th year onwards rm7500. Malaysia used to have a capital gains tax on real estate but the tax was repealed in april 2007. Malaysian rpgt calculator for people looking to sell their home or property. Thanks to the new measures announced during budget 2019 malaysians who are selling off their property in the sixth and subsequent years of ownership will now have to pay a 5 rpgt.

Foreigners and companies will also see an increase in rpgt rates from 5 to 10. As you can see from the above example david saved about rm7 500. Rpgt rm300 000 x 5 rpgt rate for 6th year onwards rm15 000. Which means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any.

Finally your tax rate will be determined by the holding period which is the number of years you have owned the property.