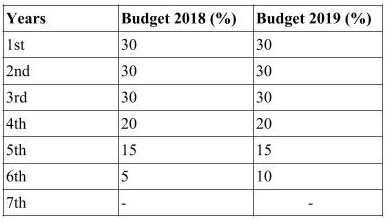

Rpgt Rate Malaysia 2018

Rpgt rm300 000 x 5 rpgt rate for 6th year onwards rm15 000.

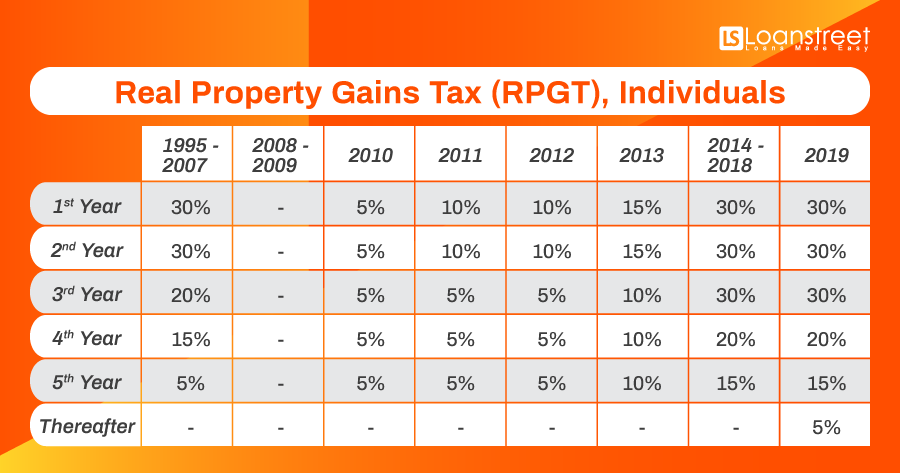

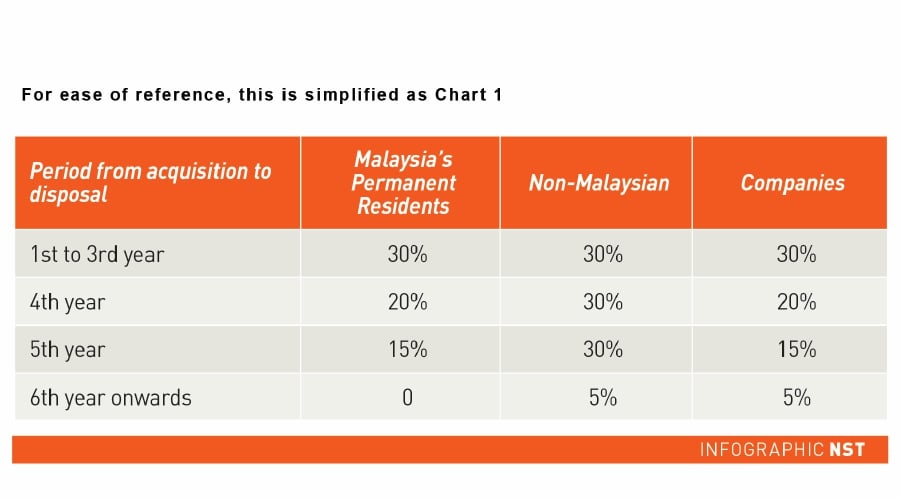

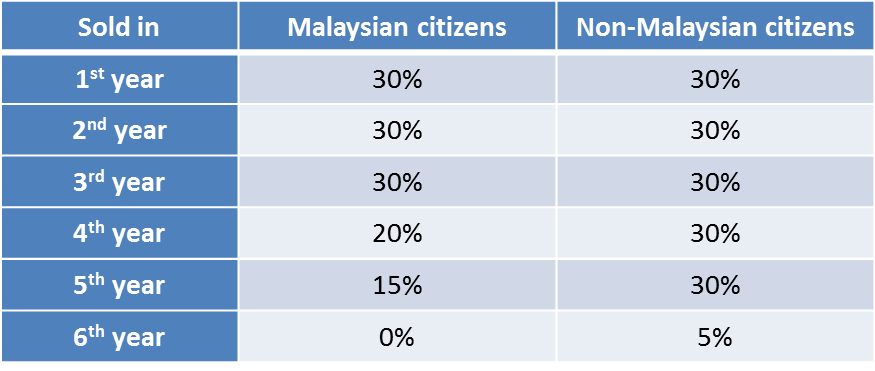

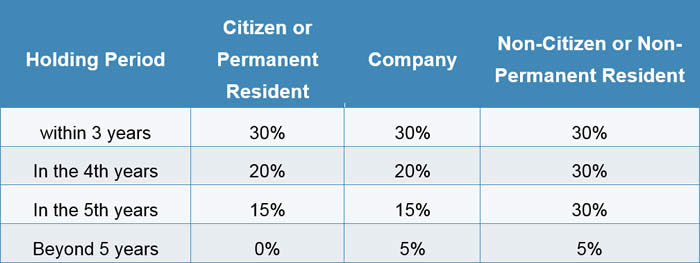

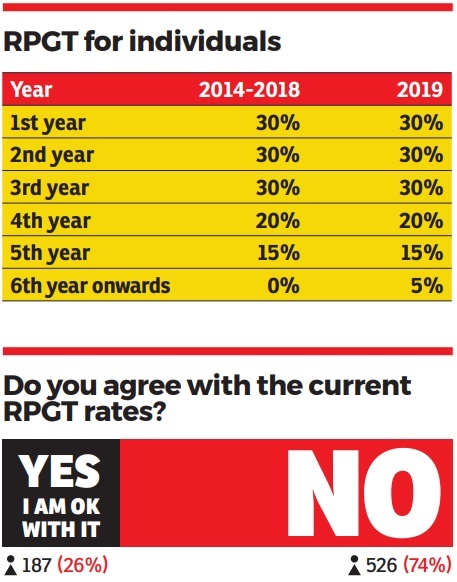

Rpgt rate malaysia 2018. Tax payable net chargeble gain x rpgt rate based on holding period rm171 000 x 5 rm8 550. The date the relevant law comes into effect. On the first 20 000. So if you re a malaysian citizen and you sell a property after holding it for four years you would be liable to pay rpgt at 20 of the chargeable gain.

As prescribed by law the purchaser s solicitors are required to retain 3 of the purchase price from the deposit and remit the same to the inland revenue board within sixty 60 days from the date of the sale and purchase agreement to meet the rpgt payable. Among the measured announced there is one to me that stood out the most. As you can see from the above example david saved about rm7 500. If you owned the property for 12 years so you ll need to pay rpgt of 5.

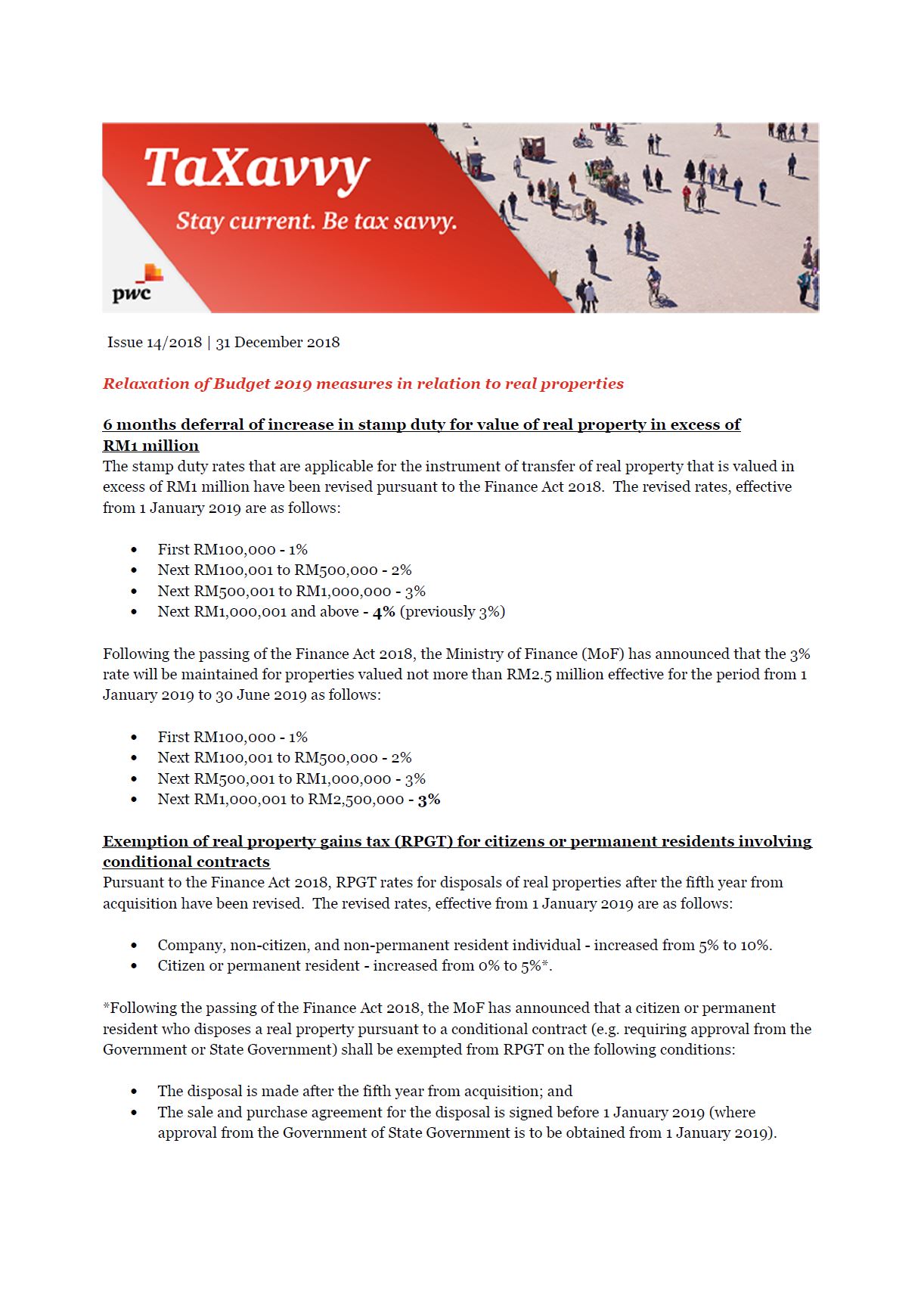

You ll pay the rptg over the net chargeable gain. In the above example where your gain was rm250 000 the rpgt payable would be rm 50 000. It is a positive move towards a higher home ownership rate among malaysians in the future. In instances where the consent of the state authority is required to sell the property to a purchaser and or charge the property to a financial institution or a court order for sale is required.

Rm15000 rm7500 rm7500 saving that s a. Irb to accept voluntary disclosures made in good faith the malaysian reserve 18 december 2018 special program for voluntary disclosure the new straits times 14 december 2018 maklumbalas akhbar lhdn sukar dihubungi talian hasil careline utusan malaysia 12 april 2018. There are some exemptions allowed for rpgt. Among the exemptions are.

Fast forward 10 years later malaysian citizens or permanent residents who disposes of his or her property within the first five years of acquiring it is subject to rpgt. When do i have to pay rpgt. It is the imposition of 5 real property gain tax rpgt for gains received from disposal of properties after the fifth year of owning them. Where the purchase consideration consists wholly or partly of cash the acquirer is required to withhold the lower of the entire cash consideration or 3 of the total acquisition price 7 where the disposer is not a citizen and not a permanent resident or not a company incorporated in malaysia w e f.

Rpgt rm150 000 x 5 rpgt rate for 6th year onwards rm7500. The rpgt rate for a non malaysian citizen is 30 on the gain if the property acquired is less than five years old and 5 on the gain if the property acquired is more than five years old. New section 21b 1a rpgt act 1976 duty of the property buyer to withhold part of the consideration and remit it to inland revenue board of malaysia irb.