Rpgt On Inherited Property Malaysia

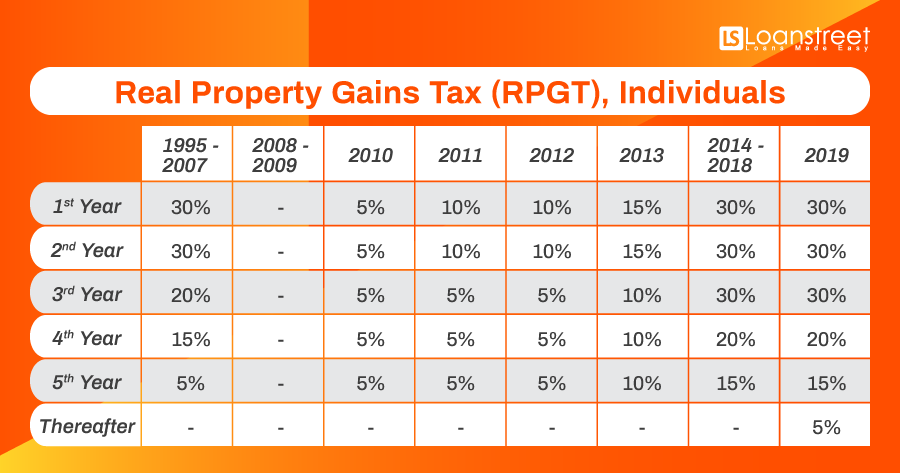

Depends on the year you inherit the property if you inherit say 2018 and you sell say 2019 then if ird considers it rpgt then it will be at 30 of the gain calculated from 2000 or which ever latest even if your parents had owned it since hundreds of years.

Rpgt on inherited property malaysia. Cost savings from real property gains tax rpgt buyers can save on paying rpgt for up to 3 property sales from now until december 2021 so this might allow more room to negotiate a price with potential buyers. Real property is defined as any land situated in malaysia and any interest option or other right in or over such land. Here s how much can you save on rpgt for a property priced at rm500 000 today which was previously bought at rm400 000. 2 foreigners non citizens.

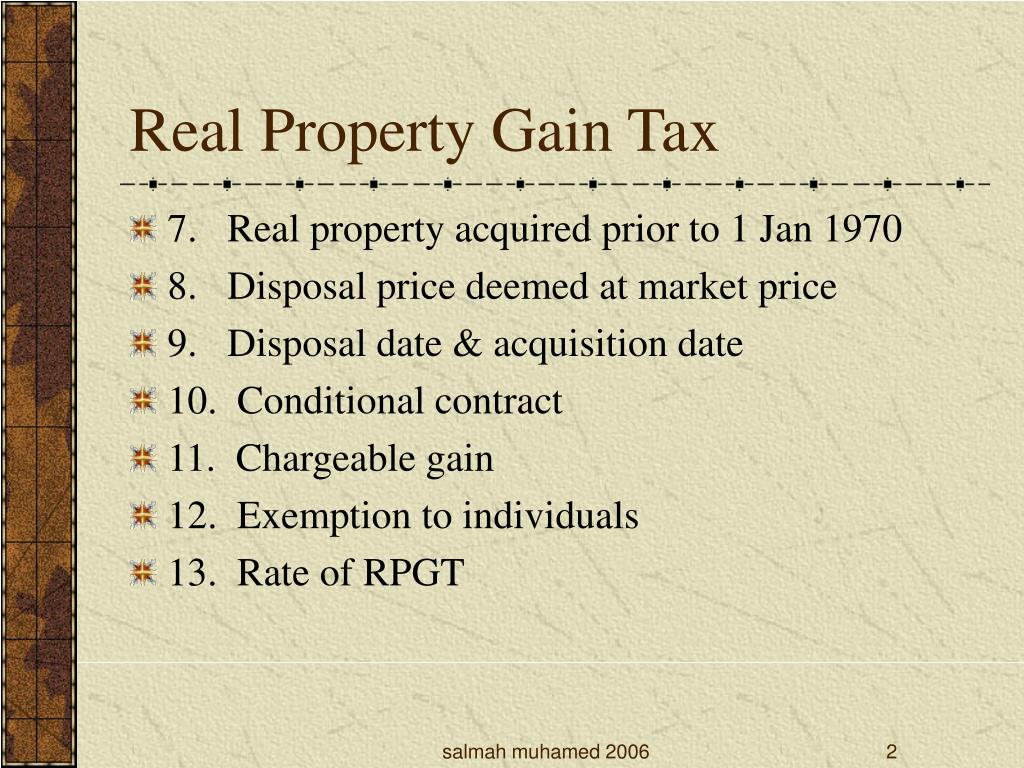

Rpc is essentially a controlled company where its total tangible assets consists of 75 or more in real property and or shares in another rpc. The rpgt was introduced through real property gain tax act 1976 rpgt act. On top of that malaysians will also be charged 5 in property taxes after the fifth year as according to the budget 2019 rpgt updates. Every person whether or not resident is chargeable to rpgt on gains arising from disposal of real property including shares in a real property company rpc.

Foreigners and companies will also see an increase in rpgt rates from 5 to 10. Rpgt is a tax chargeable on the profit gained from the disposal of a property and is payable to the inland revenue board. This exemption applies to each and every disposal of property that an individual makes. Which means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any.

An individual who is a malaysian citizen or a permanent resident will be given a once in a lifetime exemption on any chargeable gain arising from the disposal of his her private residence if he she elects in writing for the exemption to apply to that private residence. For example a bought a piece of property in 2000 at a value of rm500 000. As such rpgt is only applicable to a seller. Thanks to the new measures announced during budget 2019 malaysians who are selling off their property in the sixth and subsequent years of ownership will now have to pay a 5 rpgt.

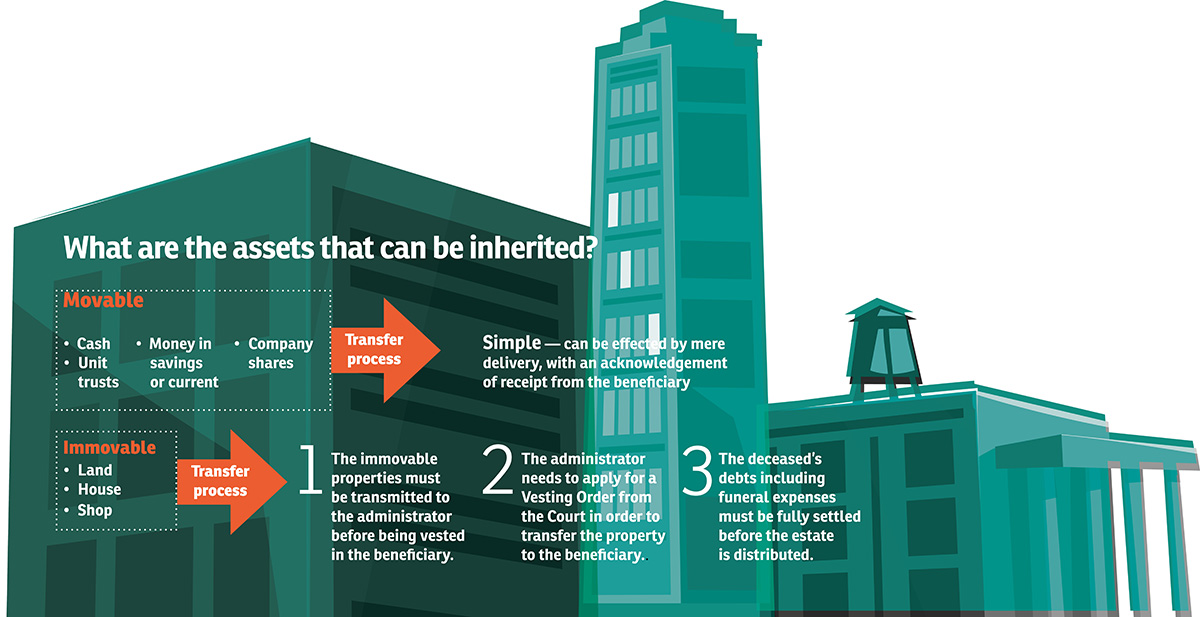

As of our concern to the topic we are discussing it only applies when the deceased s property is transferred to the purchaser instead of the intended beneficiary otherwise it is exempted from rpgt. Subsequently a sold the property to b at the value of rm700 000 gaining rm200 000 from the disposal of the property. Real property gains tax rpgt is a form of capital gains tax that homeowners and businesses have to pay when disposing of their property in malaysia. Real property gains tax rpgt exemptions are available in the following circumstances.