Rpgt Exemption Malaysia 2019

The following are some examples of exemptions from rpgt.

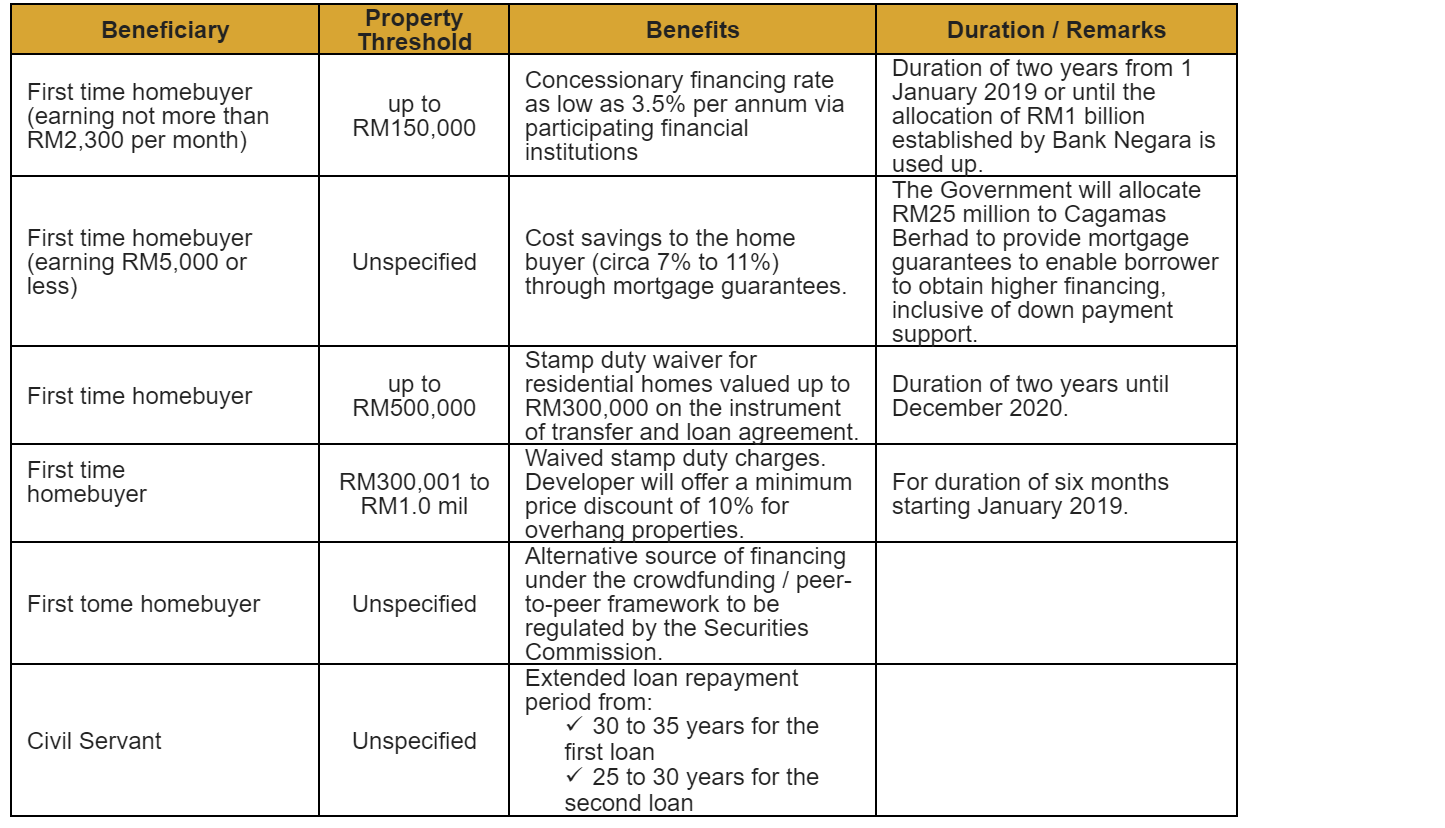

Rpgt exemption malaysia 2019. According to the rpgt act certain tax exemptions apply to profits on selling property. The government has decided to exempt the real property gains tax rpgt to malaysians who sell individual properties that are priced rm200 000 and below. Read this for more info on rpgt in malaysia 2019. According to a statement by finance minister lim guan eng the rpgt exemption effective from jan 1 2019 were for the disposal of properties including low cost houses low medium cost houses and affordable houses from the sixth year onwards.

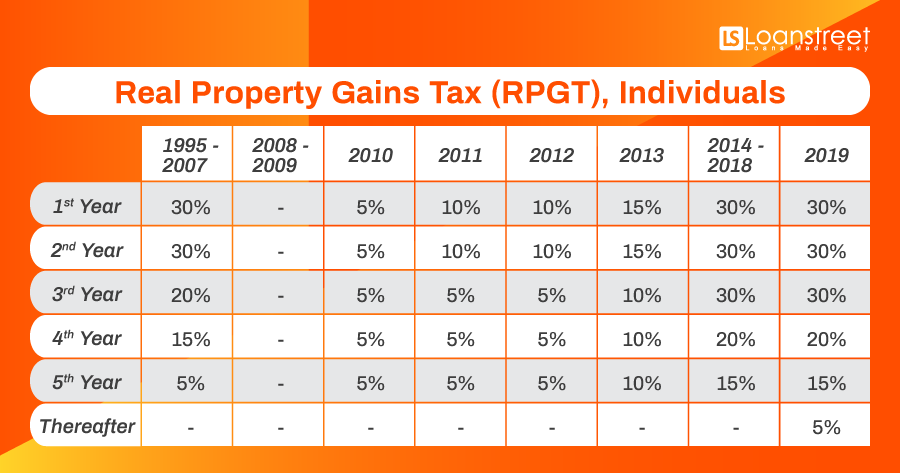

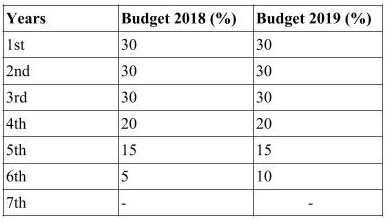

According to a statement by finance minister lim guan eng today the rpgt exemption effective from jan 1 2019 are for the disposal of properties including low cost houses low medium cost houses and affordable houses from the sixth year onwards. First introduced in 1995 the latest iteration of rpgt rates in 2019 are expected to dampen soaring prices with a tax imposed on any profit made from the sale or disposal in financial parlance of a property. Existing exemptions on rpgt include the disposal of a personal residence once in a lifetime disposal rm10 000 or 10 of chargeable gain transfer of ownership as a gift and allowable losses. Gain accruing to an individual who is a citizen or a permanent resident in respect of the disposal of one private residence.

Finance minister lim gian eng stated that this exemption will take effect from 1 january 2019 onwards. An amount of rm10 000 or 10 of the chargeable gain whichever is greater accruing to an individual. Is malaysian entitled for rpgt exemption. The rpgt act defines a private residence as a building or part of a building owned by an individual or occupied as a place of residence.

According to a statement by finance minister lim guan eng the rpgt exemption effective from jan 1 2019 were for the disposal of properties including low cost houses low medium cost houses and affordable houses from the sixth year onwards. What are the rpgt act exemptions. It based on the date of the sale purchase agreement. The real property gains tax rpgt in malaysia is definitely not a new subject for property owners veteran investors especially.

Rm 10 000 or 10 of chargeable gain if you decide not to utilize the once in your lifetime rpgt exemption then you may utilize a rpgt exemption where the sum is higher of rm 10 000 or 10 of your chargeable gain. How to calculate the year of your property disposal.