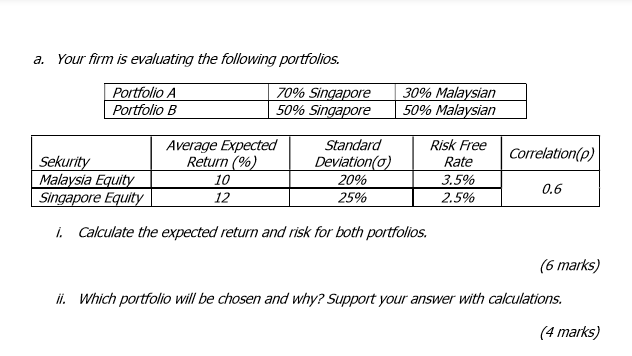

Risk Free Rate Malaysia

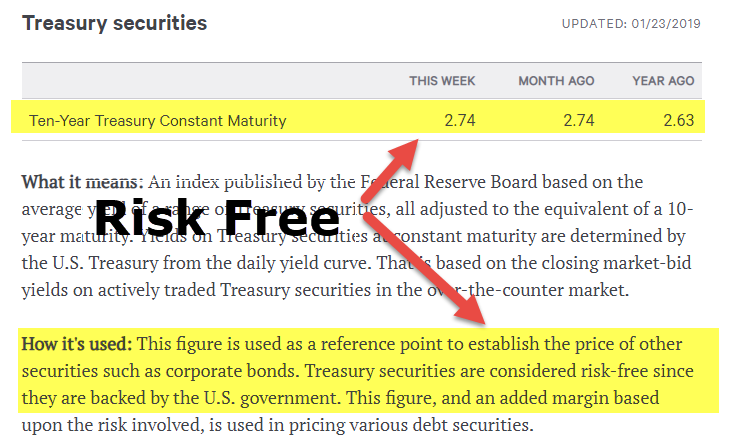

The malaysia 10y government bond has a 2 646 yield.

Risk free rate malaysia. A reference rate that is computed based on weighted average volume of the interbank usd myr fx spot rate transacted by the domestic financial institutions and published daily at 3 30 p m. You ll find the closing yield open high low change and change for the selected range of dates. Central bank rate is 1 75 last modification in july 2020. Bank negara malaysia and etp bursa malaysia bonds sdn bhd as from 10 march 2008.

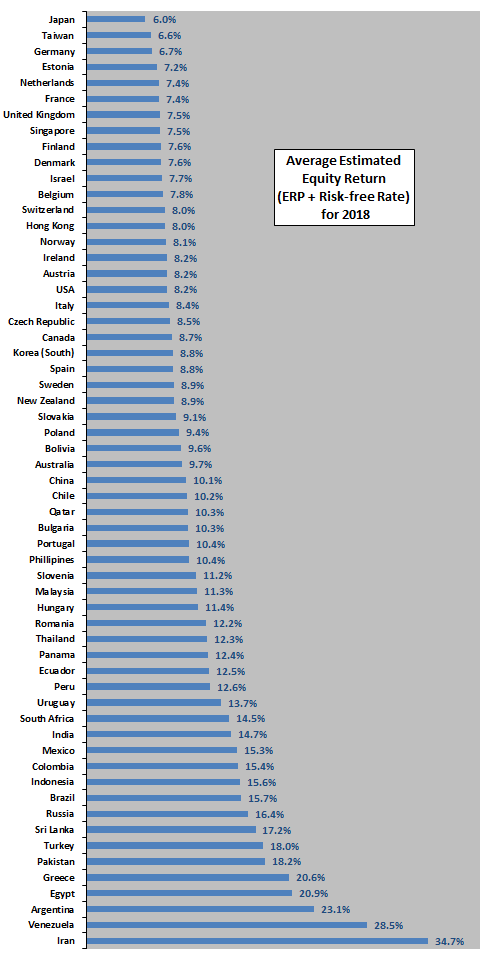

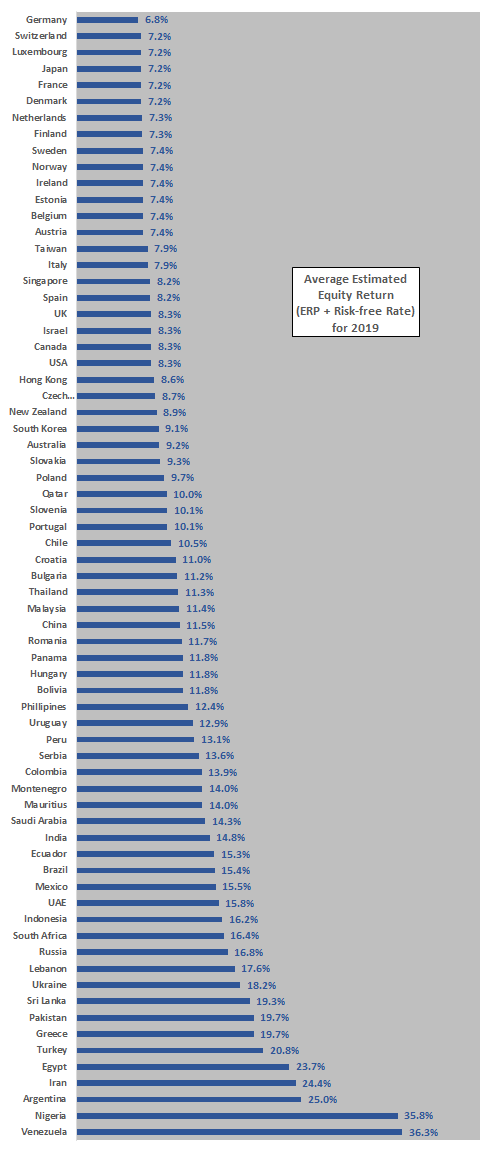

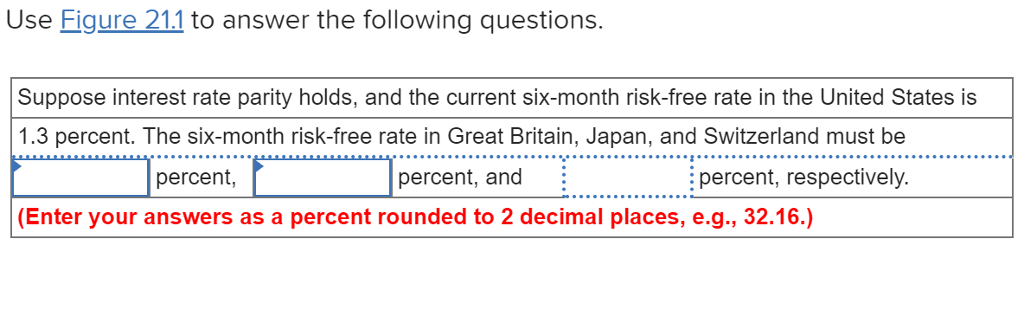

Historically the malaysia government bond 10y reached an all time high of 5 35 in april of 2004. For example if the current market value is mv 0 100 and dividend forecasts are d 1 4 d 2 4 d 3 4 then a growth rate of 0 results in an implied cost of capital of 4 if the growth rate assumption is 5 the implied cost of capital is 8 6. To estimate the long term country equity risk premium i start with a default spread which i obtain in one of two ways. Naively applied it can have a huge impact on implied cost of capital estimates.

Daily 3 and 6 month noon forward swap rates of ringgit. The malaysia credit rating is a according to standard poor s agency. Magy10yr is used as risk free rate market return is the capital weighted average of the internal rate of return for all major index numbers. Current 5 years credit default swap quotation is 45 18 and implied probability of default is 0 75.

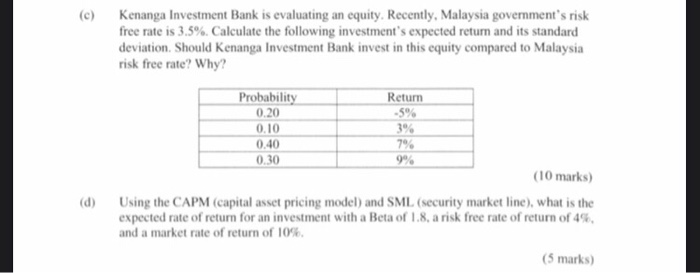

Malaysia 10y bond yield was 2 66 percent on monday september 7 according to over the counter interbank yield quotes for this government bond maturity. Get free historical data for malaysia 10 year bond yield. Risk free rate of 3 71 based on the 10 year malaysian government bond yields expected market return of 11 55 from bloomberg. Bank negara malaysia lowered its overnight policy rate by 25 bps to 1 75 percent during its july meeting bringing borrowing costs to record lows aiming to provide additional policy stimulus to accelerate the pace of economic recovery from the coronavirus induced crisis.

In the case of malaysia the malaysia govt bonds 10 year yield bloomberg ticker.