Rental Income Tax Malaysia

Now there are certain requirements which need to be met first before you can be qualified for this income tax exemption.

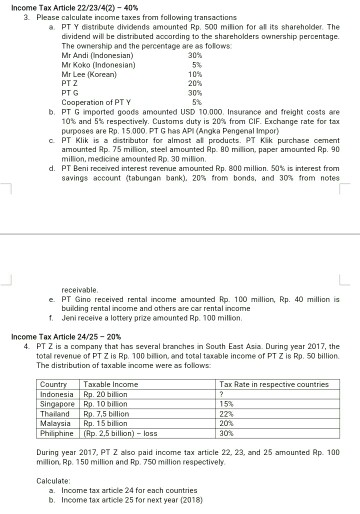

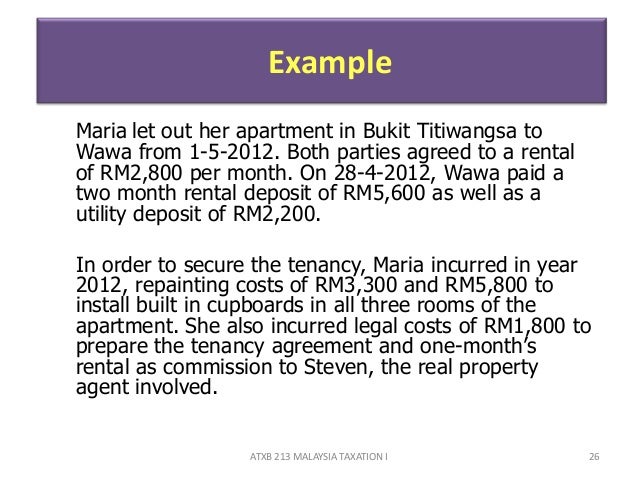

Rental income tax malaysia. Income from renting out a residential home is given a 50 income tax exemption provided it meets the following conditions. Example 7 azrie owns 2 units of apartment and lets out those units to 2 tenants. They are as follows. Income received from the letting is charged to tax as rental income under paragraph 4 d of the ita.

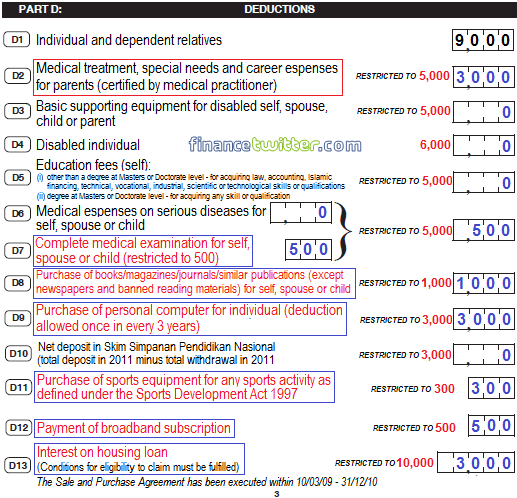

Facts are the same as in example 3 but maintenance services and support services are provided by zura property sdn bhd. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. To get the net amount you have to deduct permitted expenses incurred from the gross rental income. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property.

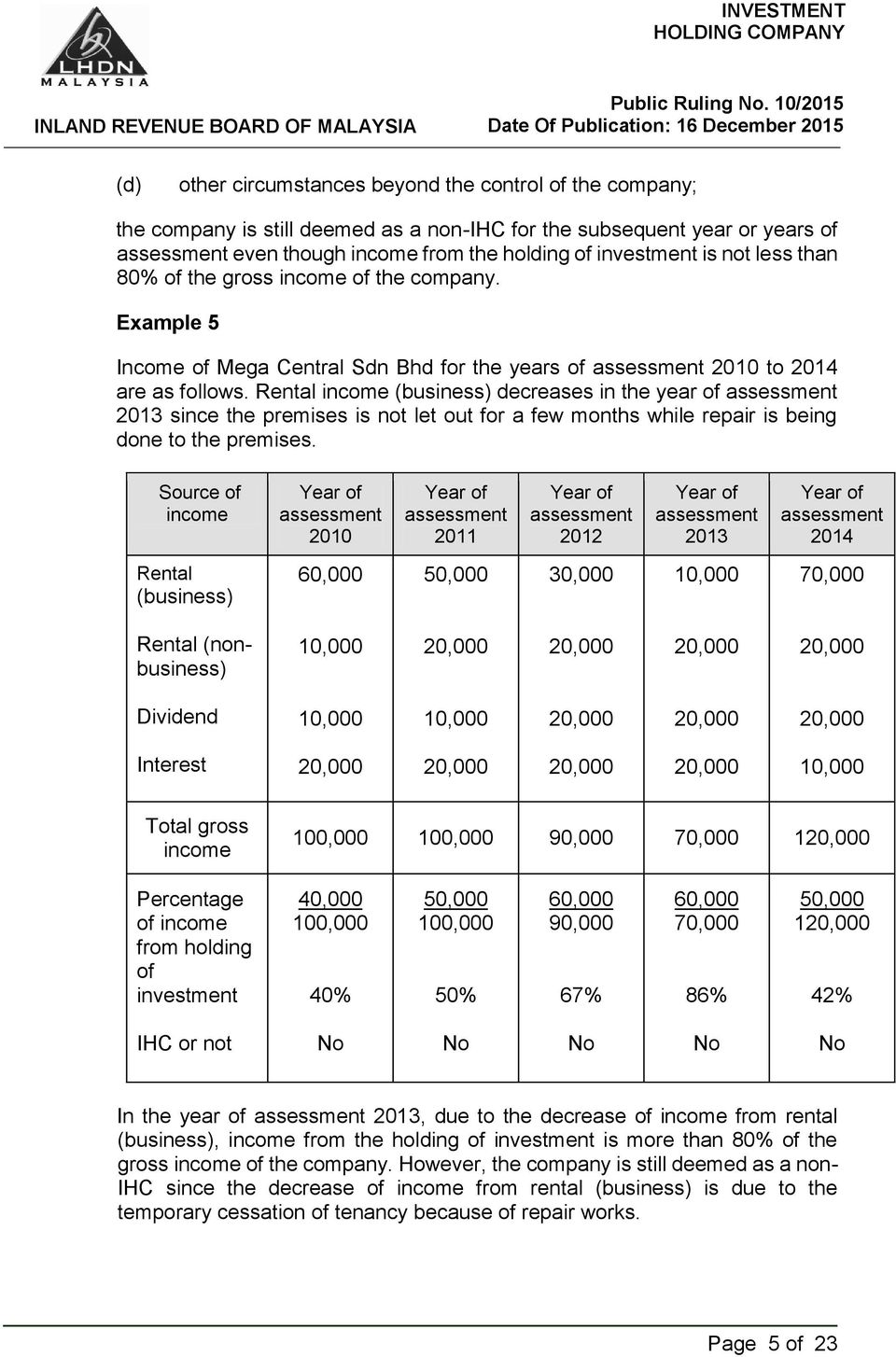

The landlord is an individual citizen who resides in malaysia and is the. The letting of the office units is treated as a non business source of yes. 19 december 2018 from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ita. Their tax treatments are as follows.

During the tabling of budget 2018 it was stated that there ll be an exemption of 50 on the statutory income of rental received by malaysian citizens who live in malaysia. The tenants are entitled to use the swimming pool tennis court and other facilities. In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967. Rental income is calculated using the net amount.

Individuals who own property in malaysia and receive a rental income will be subjected to income tax. Foreigners and those not residing within malaysia are also charged a flat 28 tax on rental income. It depends on whether or not adam s tax on rental income from this property in malaysia is under section 4 a business income or section 4 d rental income because they would be treated differently. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file.

Inland revenue board of malaysia date of publication. In order to promote affordable accommodation to the needful the malaysian government through budget 2018 offered a tax exemption of 50 on statutory income of rental received by malaysian citizens.