Rental Income Tax Malaysia 2019

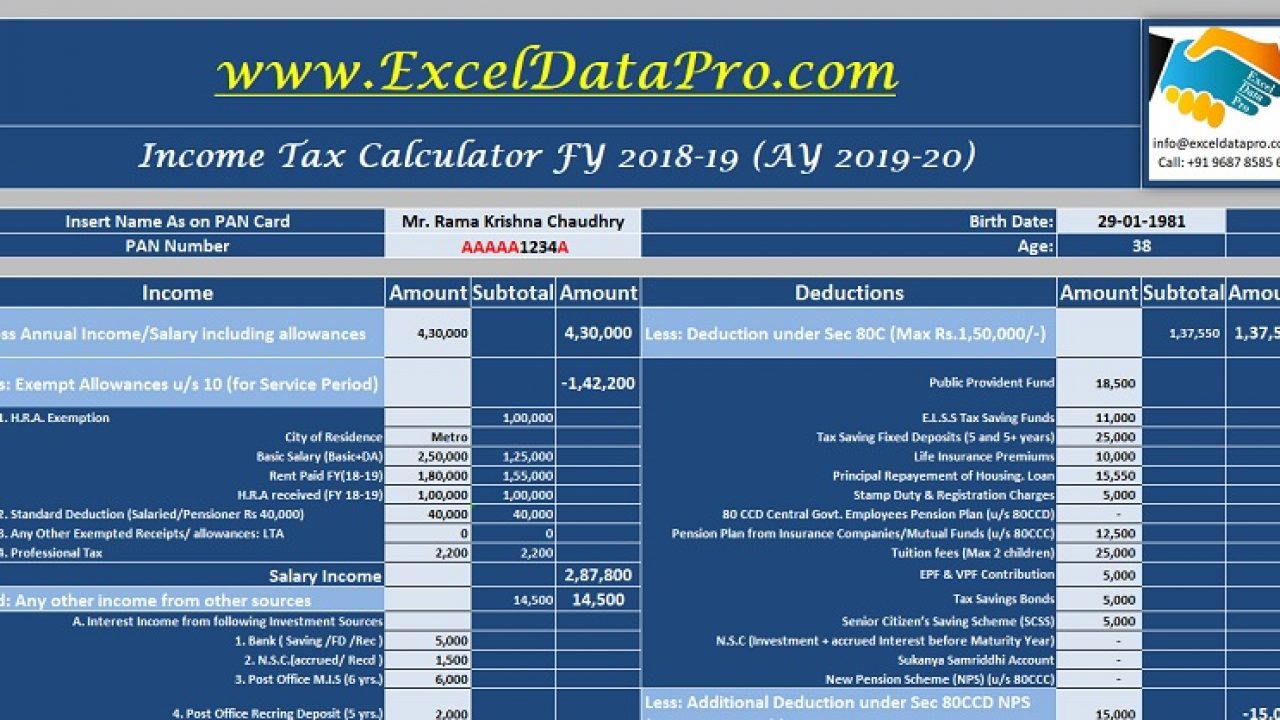

Income from renting out a residential home is given a 50 income tax exemption provided it meets the following conditions.

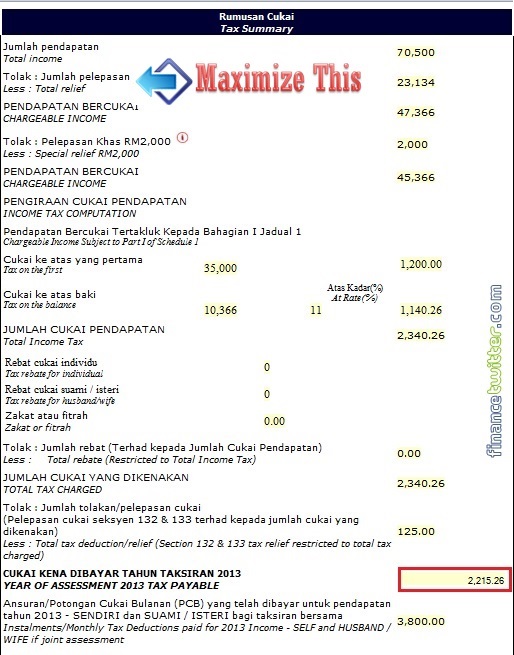

Rental income tax malaysia 2019. In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967. To find out if your rental income can be exempted from income tax first you d need to know how it s calculated. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Individuals who own property situated in malaysia and receive rental income in return are subject to income tax.

Foreigners and those not residing within malaysia are also charged a flat 28 tax on rental income. 2019 and it. The landlord is an individual citizen who resides in malaysia and is the. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

If there s a rental loss you re not required to disclose that in your tax filings. Such rental income is explained under section 4 d of the act.