Rental Income Public Ruling

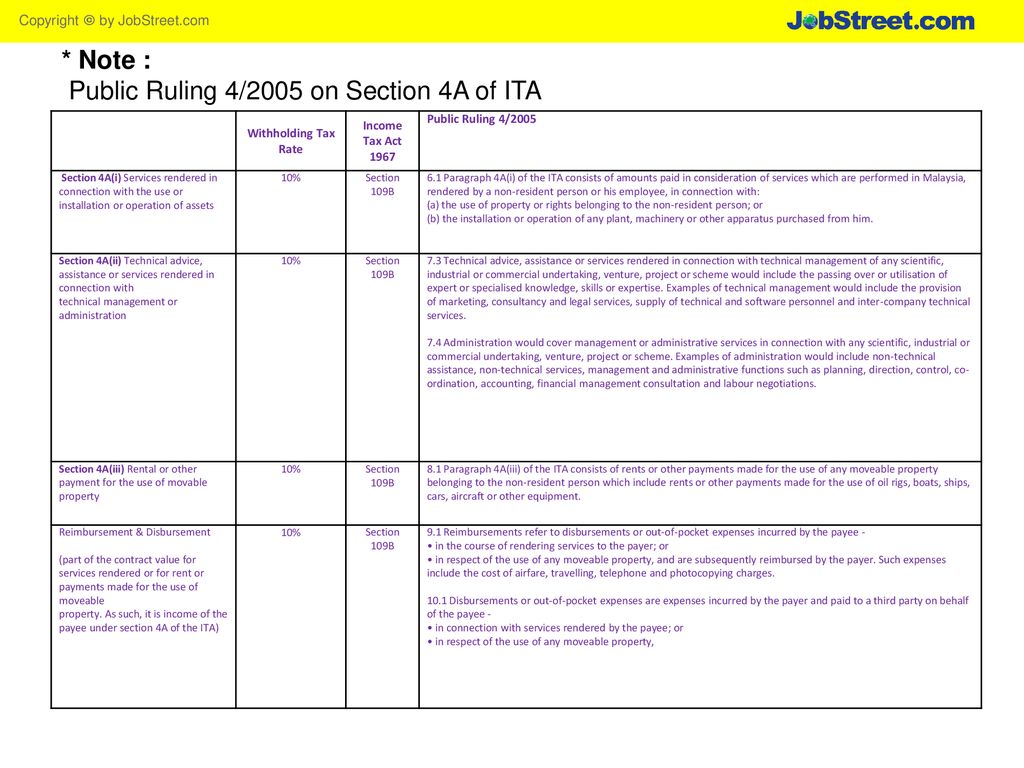

Director general s public ruling section 138a of the income tax act 1967 ita provides that the director general is empowered to make a public ruling in relation to the application of any provisions of the ita.

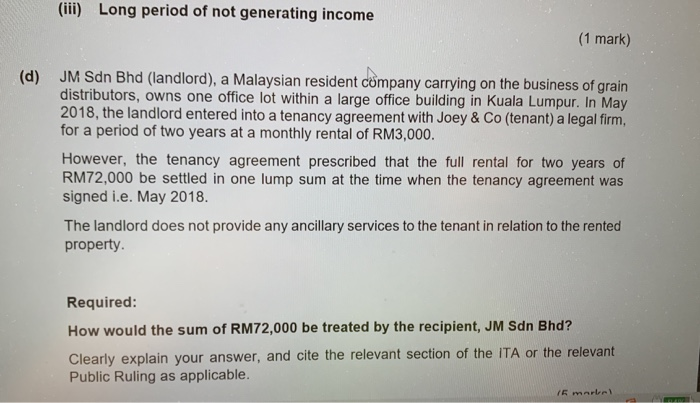

Rental income public ruling. The inland revenue board irb has issued public ruling no. This pr which supersedes pr no. 19 june 2015 page 6 of 30 7 2 as rental income is trea ted as a business source of a reit ptf the remuneration of a reit ptf manager is deductible. In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967.

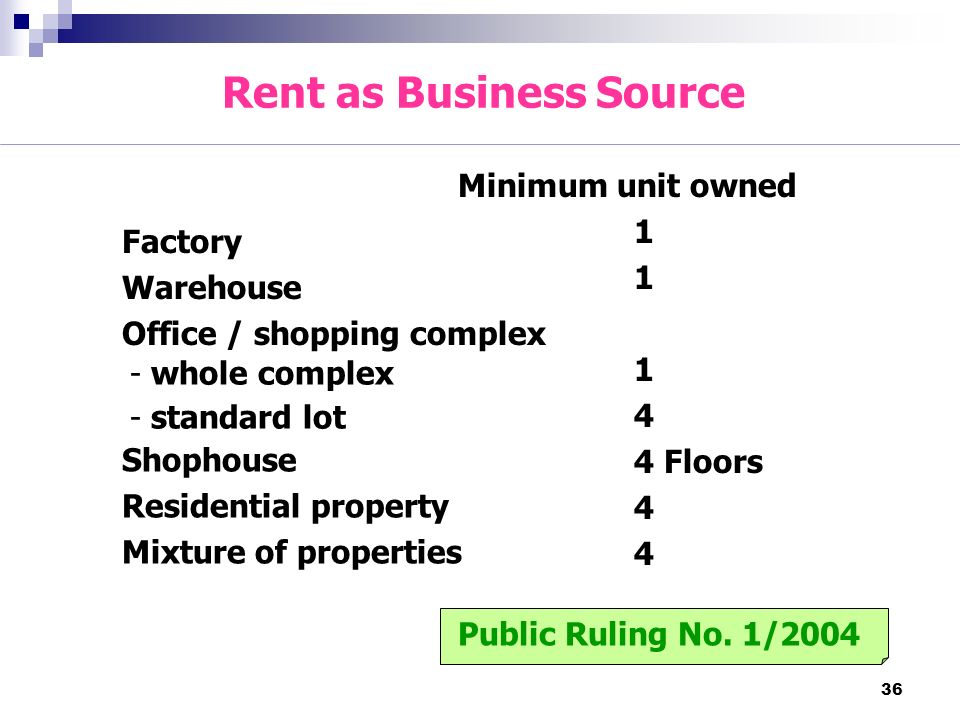

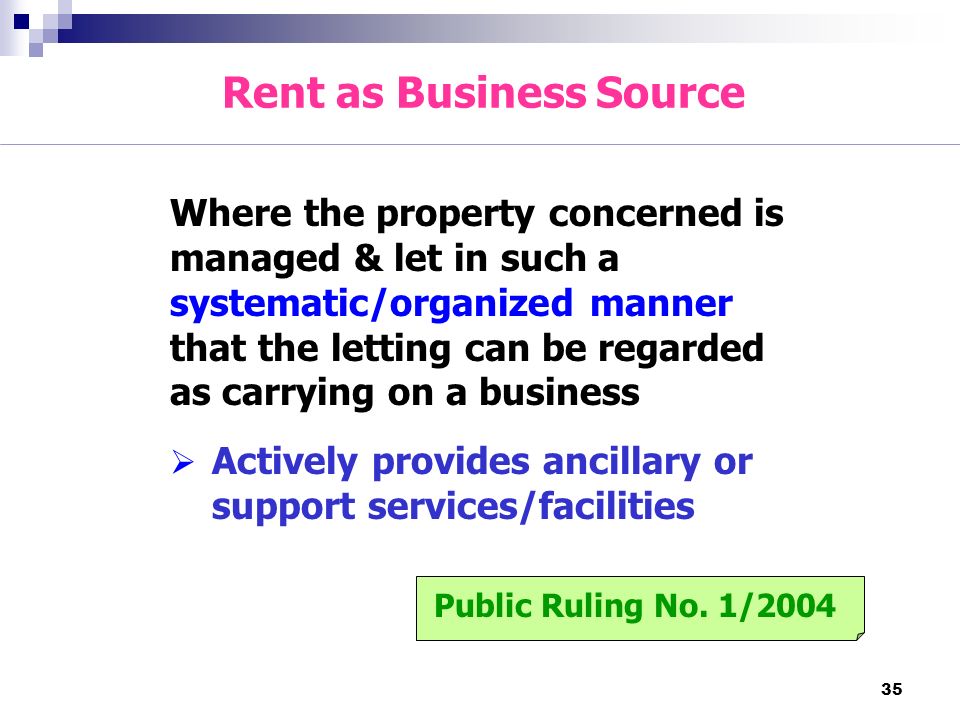

It sets out the interpretation of the director general of inland revenue in respect of the particular tax law and the policy and procedure that are to be applied. 1 2004 issued on 30 june 2004 provides clarification on. However rent may not fall under the exclusion in various circumstances such as when substantial personal services are provided to lessees if more than 50 of the rent is for the use of personal property if the property is debt financed income or leased to a controlled entity or if the organization is exempt under sections 501 c 7 501 c 9 or irc 501 c 17. 19 december 2018 from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ita.

Director general s public ruling section 138a of the income tax act 1967 ita provides that the director general is empowered to make a public ruling in relation to the application of any provisions of the ita. A public ruling is issued for the purpose of providing guidance for the public and officers of the inland revenue board. 3 6 rent or rental income or income from letting includes any amount received for the use or occupation of any real property or part thereof including premiums and other receipt in connection with the use or occupation. Example 7 azrie owns 2 units of apartment and lets out those units to 2 tenants.

The effective date of each relevant paragraph in a public ruling follows the effective date of the related provisions in the income tax act 1967 income tax exemption income orders or income tax rules. A public ruling is published as a guide for the public and officers of the inland revenue board of malaysia. I letting of real property as a business source under paragraph 4 a of the income tax act 1967 ita. Income from letting of real property.

However the trustee fee is not an allowable expense under subsection 33 1 of the ita. 12 2018 inland revenue board of malaysia date of publication. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property.

/cdn.vox-cdn.com/uploads/chorus_image/image/66092910/GettyImages_172312621.0.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/19865430/shutterstock_1407776159.jpg)