Refinancing Home Loan Malaysia

If you already have an existing housing loan in malaysia and want to change to another product or lender without moving home it is known as a refinancing.

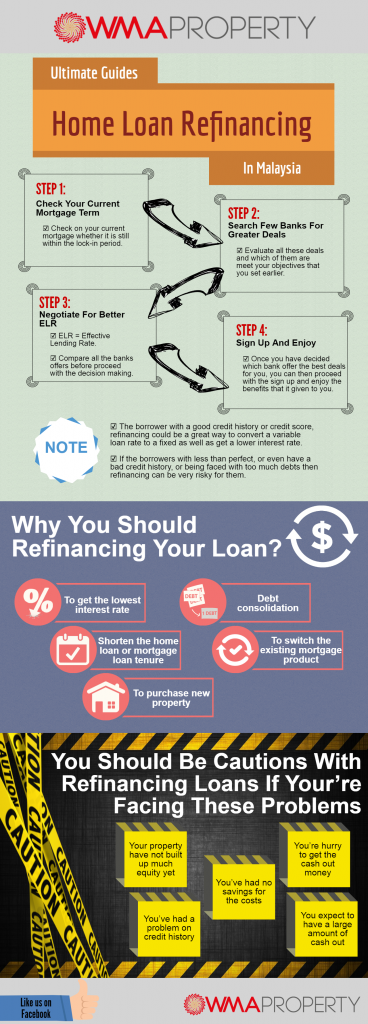

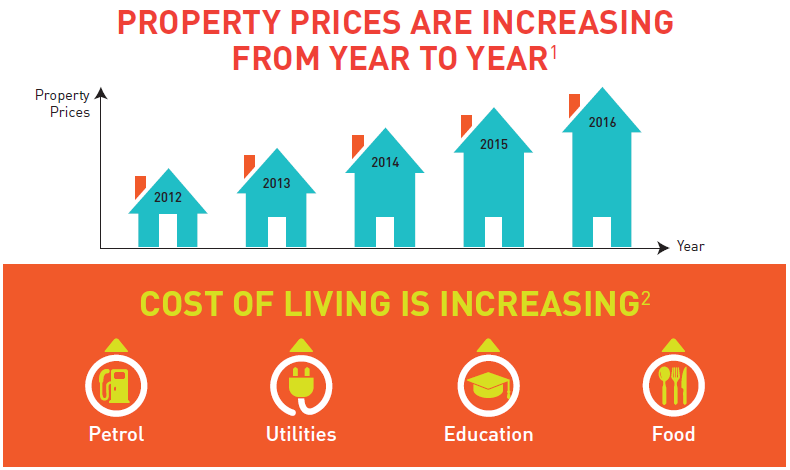

Refinancing home loan malaysia. Compare refinance loan packages of cimb ocbc public bank rhb maybank hong leong hsbc etc and apply for a lower interest refinance housing loan. With interest rates trending lower it is a good time to review restructure and refinance your existing loans. It can be for getting extra cash to pay off the existing high interest rates loan facility house renovation children education to get lower rates etc. The first thing you need to do is call up your existing bank and check your penalty period.

We offer a hassle free approach for finding the best public bank refinance housing loan. Maybank london residential home financing financing the purchase of your property for investment whether you need to finance your latest investment property purchase or re finance your existing investment property in london we offer competitive rates flexible repayment options and cross border lending where applicable. Check your home loan penalty. How do home loans in malaysia work.

You have to make sure your current home loan doesn t have penalty fees or the penalty period has ended. Do you need refinance home loan in malaysia. Most banks will have a penalty clause and it s crucial to check on this. All q a are from our customer if you have any questions about refinancing please go to our contact us page and drop us your questions.

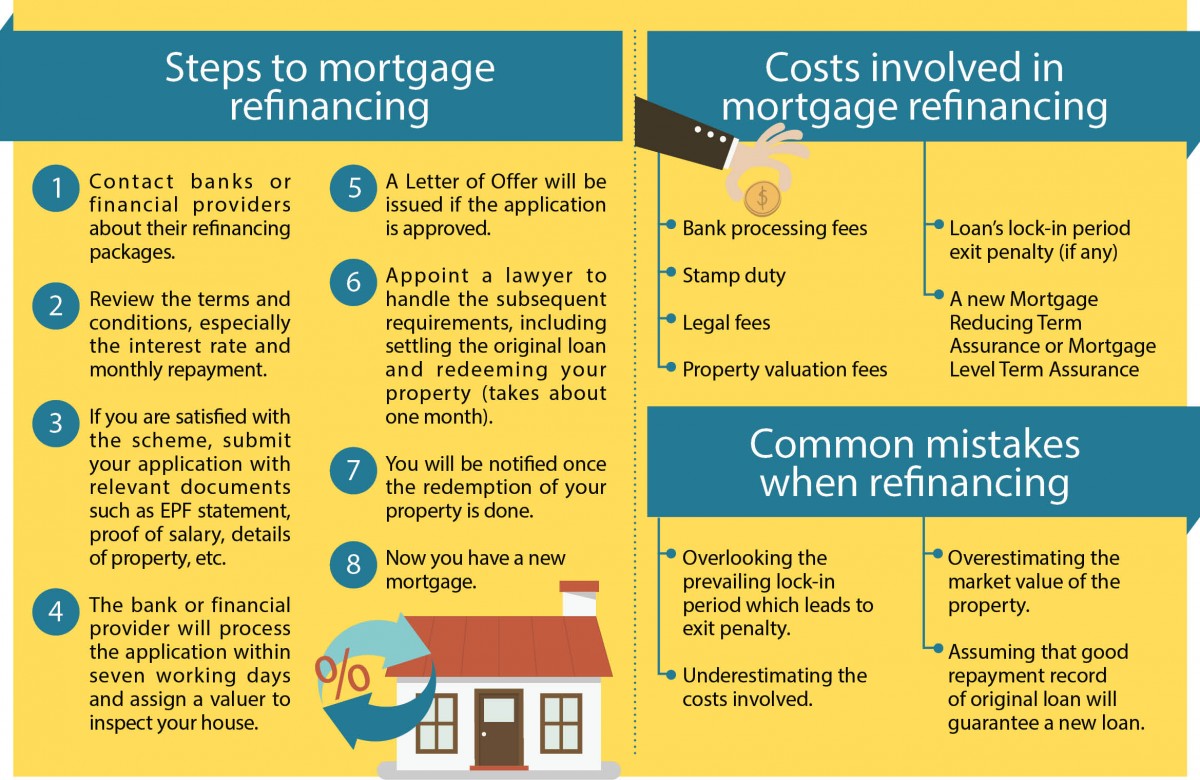

We we shall reply to you as soon 1 question. To comply with gdpr we will not store any personally identifiable information from you. Therefore it is essential to check the penalty period status before proceeding for refinancing. Steps to refinancing your home malaysia 2020 1.

Following the latest cut of interest rates by malaysia s central bank most commercial banks have already revised their base lending rates blr from 6 75 to 5 75 6 0. The check on the penalty is essential to make sure you are not penalized by refinancing to another bank. Refinancing question and answer q a. Get interest rate from as low as 4 15 on home refinancing with zero entry cost.

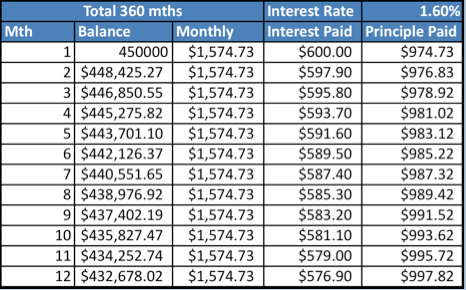

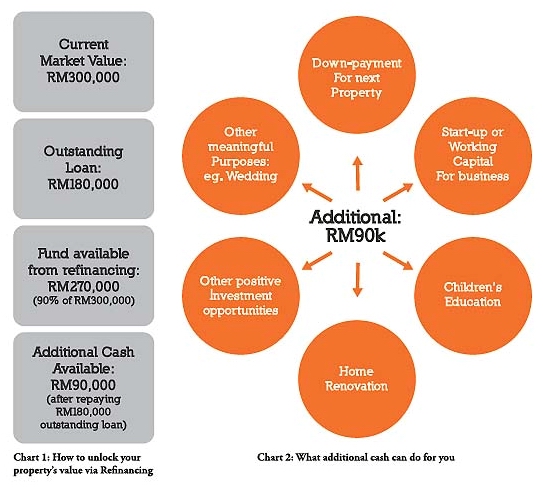

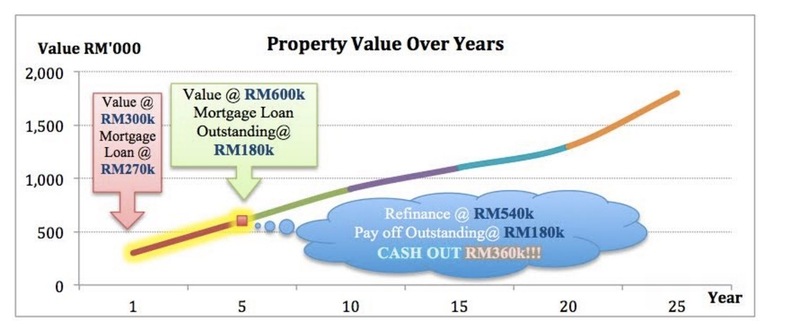

Do a quick check on your monthly repayment with loanstreet s home loan calculator and apply online right away. I bought a house in 2007 purchase price is rm300 000. Compare the cheapest housing loans from over 18 banks in malaysia here. And if the account closed within the stipulated period the bank will charge a penalty fee of 2 3 from the original home loan amount.

Interest rates for housing loans in malaysia are usually quoted as a percentage below the base rate br. Malaysia home loan refinance calculator to calculate your monthly savings for your house loan installment with estimation on total pay off or cash out. I took a loan of rm270 000.