Real Property Gains Tax

/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)

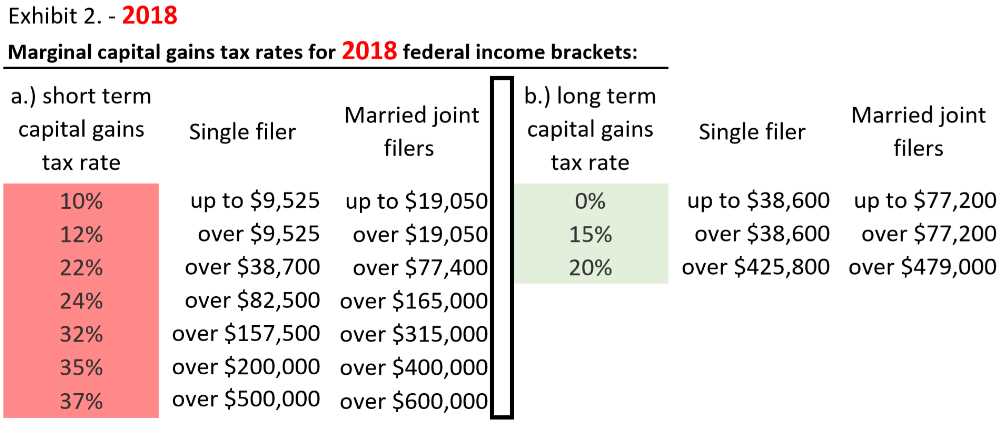

Everybody else pays either 15.

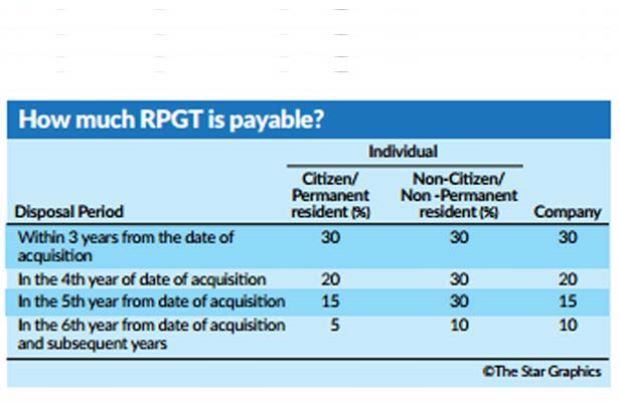

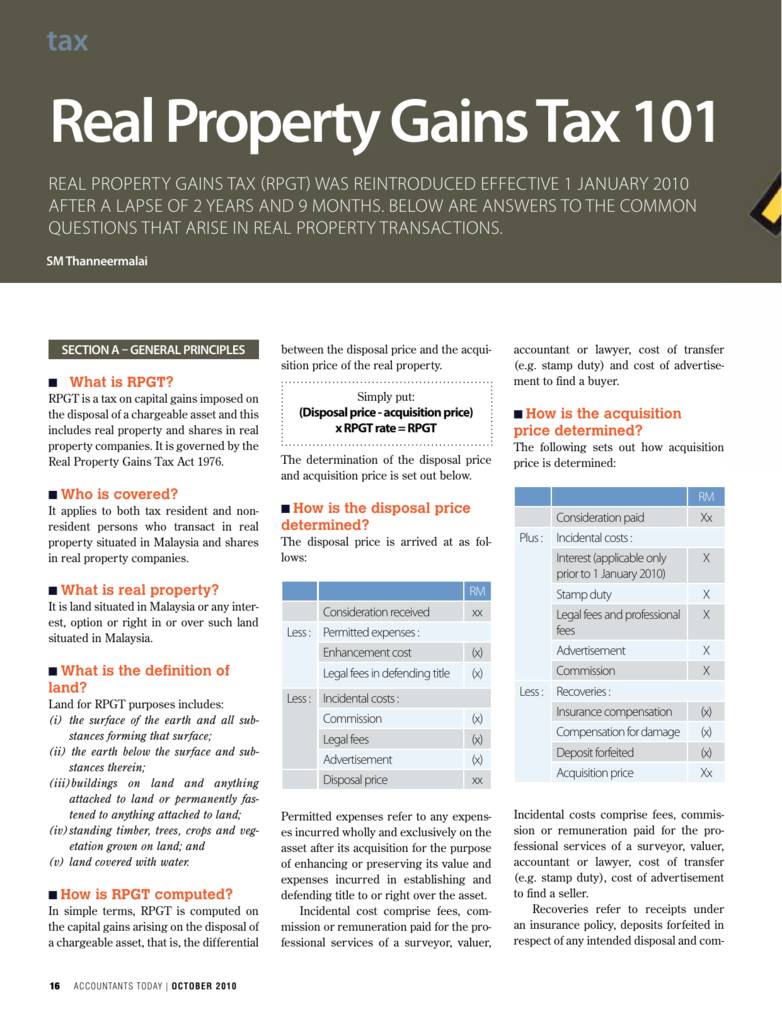

Real property gains tax. The irs taxes capital gains at the federal level and some states also tax capital gains at the state level. For the 2019 tax year single taxpayers can exclude up to 250 000 in capital gains on their home sale while married couples filing jointly can exclude up to 500 000. The rates are much less onerous. Here 39 s what you need to know about capital gains taxes in texas.

If you can exclude all of the gain you do not need to report the sale on your tax return. If you have gain that cannot be excluded it is taxable. July 28th 2020 leave a comment effective from 28 july 2020 rpgt exemption will be given to malaysians for the disposal of residential homes before dec 31 next year. Many people qualify for a 0 tax rate.

Real property gains tax exemption is now gazetted. Long term capital gains tax rates typically apply if you owned the asset for more than a year. The profit you make when you sell your stock and other similar assets like real estate is equal to your capital gain on the sale. The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling.

Includes short and long term 2019 federal and state capital gains tax rates. The capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. While texas has favorable tax laws property owners must still pay capital gains in certain situations.

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81.png)

/will-i-pay-tax-on-my-home-sale-2389003-v4-5b4cb96046e0fb0037e65b73.png)