Real Property Gains Tax Malaysia 2018

Disposal of assets in connection with securitisation of assets.

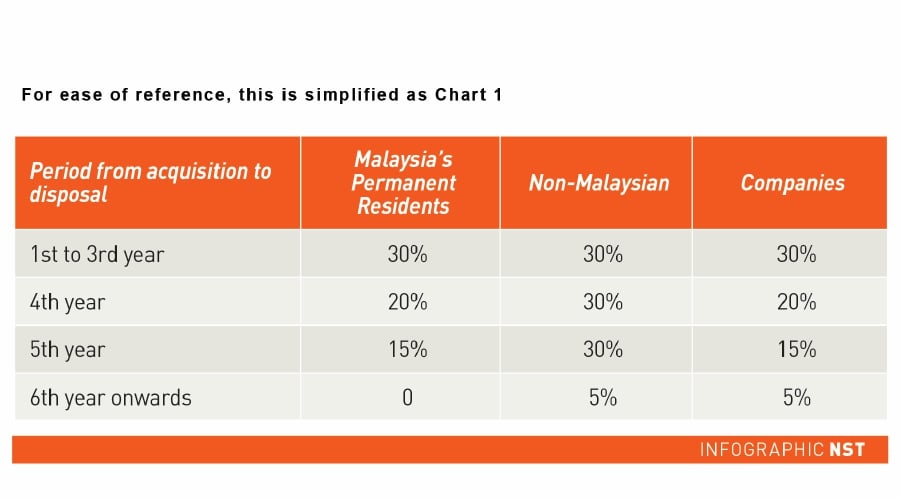

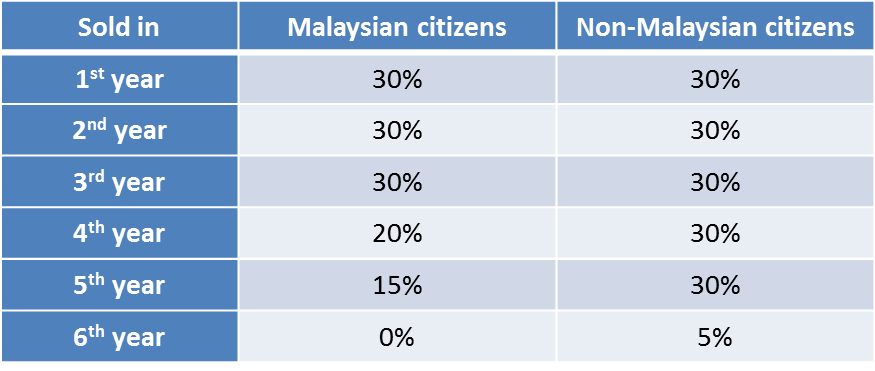

Real property gains tax malaysia 2018. Imposition of penalties and increases of tax. I believe it impacts a lot more on long term property investors over short term speculators who gain from flipping properties. If you re not a malaysian citizen the rate is 30 if you re selling a property within 5 years or 5 if you ve owned it for longer than that. Real property gains tax rpgt is a form of capital gains tax that homeowners and businesses have to pay when disposing of their property in malaysia.

Gain accruing to an individual who is a citizen or a permanent resident in respect of the disposal of one private residence. Real property gains tax rpgt in malaysia. The following is the summary of the amendments real property gain tax. You don t have to pay capital gains tax in malaysia but you do have to pay a specific tax on gains from property.

Laws of malaysia act 169 real property gains tax act 1976 an act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto. Disposal of assets to reits and property trust funds. Assessment of real property gain tax. Property law property law in malaysia real property gains tax act 1976 real property gains tax real property gains tax exemption order finance act 2018 conveyancing.

An amount of rm10 000 or 10 of the chargeable gain whichever is greater accruing to an individual. However with the new section effective 1 january 2018 if the property seller is not a malaysian citizen or not a malaysian permanent resident the buyer is required to withhold 7 of the cash consideration and remit it to irb. 7 november 1975 be it enacted by the seri paduka baginda yang di pertuan agong with the advice and consent of the dewan negara. As such rpgt is only applicable to a seller.

Source 1 source 2 source 3 3 january 2018 real property gains tax. The star 3 4 april 2018 tax compliance 101 malaysia sme 29 january 2018 malaysia s robust online tax platform keeps getting better the malaysian reserve 26 january 2018 2017. Which means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any. This however does only apply to citizens and permanent residents.

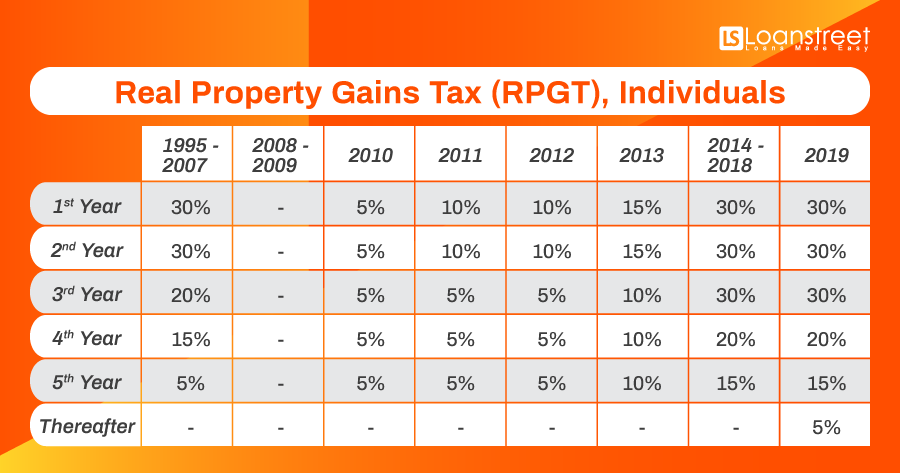

It was suspended temporarily in 2008 2009 and reintroduced in 2010. If you sell your house with a loss you don t have to pay any rpgt because you didn t make any profit.

2.png)