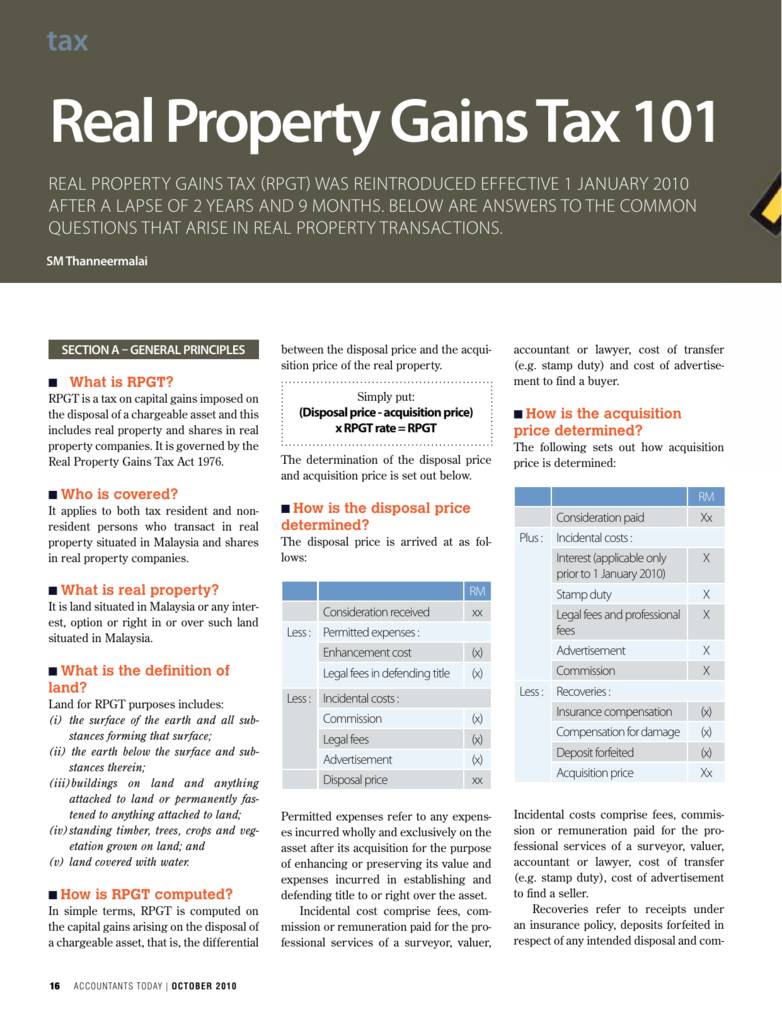

Real Property Gain Tax

July 28th 2020 leave a comment effective from 28 july 2020 rpgt exemption will be given to malaysians for the disposal of residential homes before dec 31 next year.

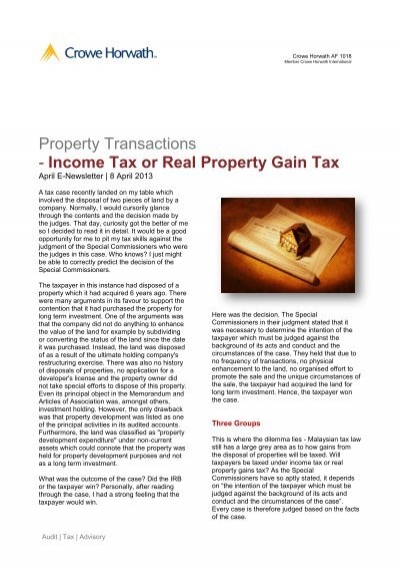

Real property gain tax. The rates are much less onerous. How to avoid the capital gains tax on real estate you could partially or fully avoid a capital gains tax on your home sale if. You see it pays to hold onto any item real. Real property gains tax exemption is now gazetted.

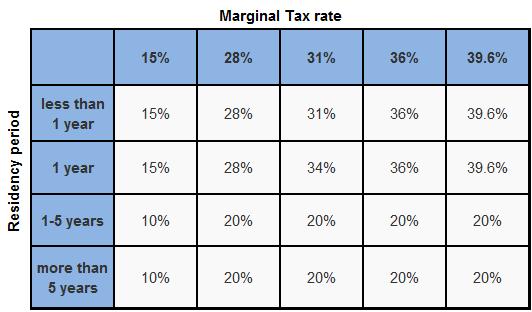

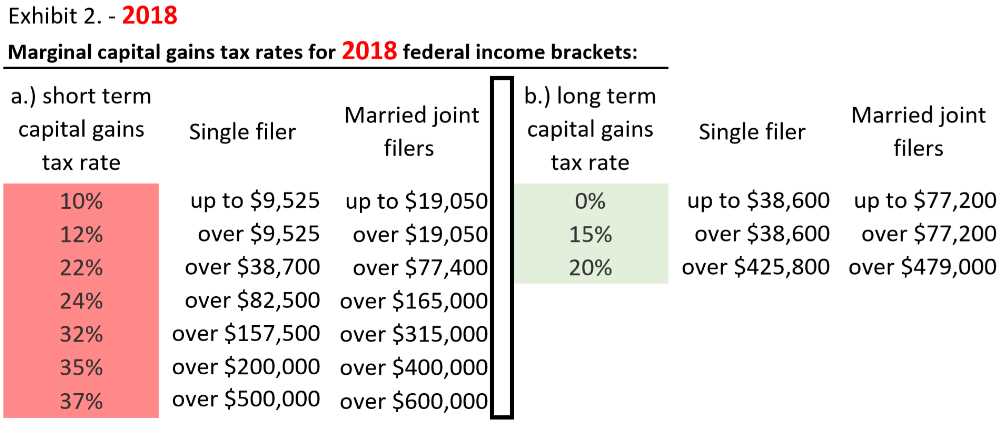

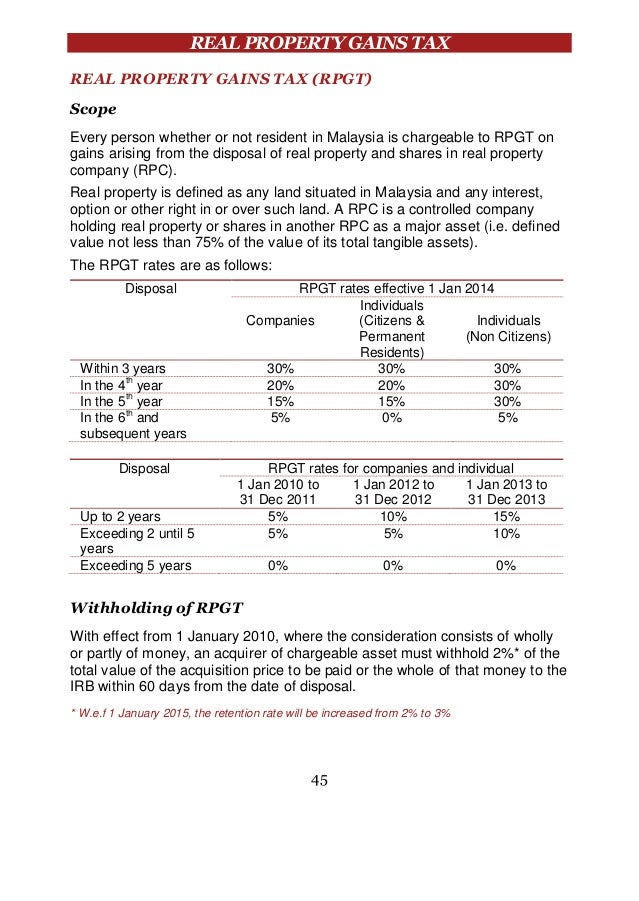

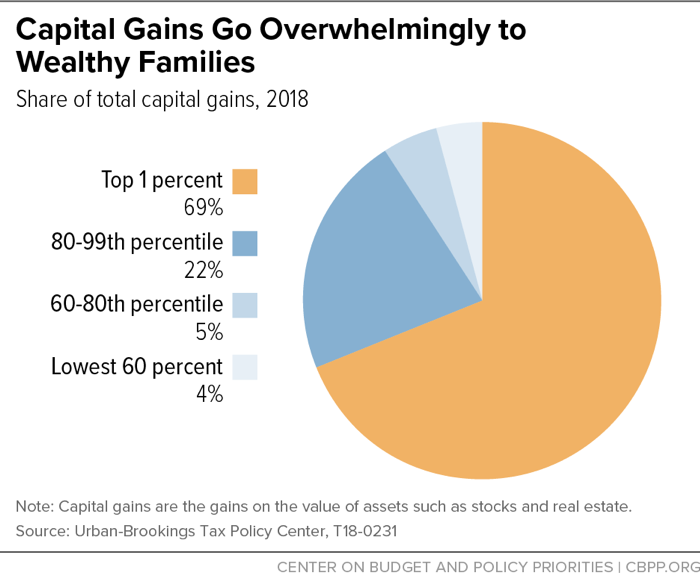

A complete guide to capital gains tax on real estate sales jul 29 2019 by matt frankel cfp when you sell an asset for more than it cost you to acquire it the difference is known as a capital. Long term capital gains tax rates typically apply if you owned the asset for more than a year. So you d pay 15 000 on the 100 000 gain saving you 7 000. Rpc is essentially a controlled company where its total tangible assets consists of 75 or more in real property and or shares in another rpc.

While texas has favorable tax laws property owners must still pay capital gains in certain situations. Many people qualify for a 0 tax rate. Your long term capital gain because of your income would fall in the 15 bracket. Here 39 s what you need to know about capital gains taxes in texas.

Every person whether or not resident is chargeable to rpgt on gains arising from disposal of real property including shares in a real property company rpc. Everybody else pays either 15. The capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. You ve owned and lived in your home for at least two of the last five.

:max_bytes(150000):strip_icc()/sale-of-your-home-3193496-final-5b62092046e0fb005051ed81.png)

/TaxPolicy.Paul.4.2.1_-_figure_1-512c20575f6b4bc6bf23ef34dee0f9c4.png)

/TaxPolicy.Paul.4.2.1_-_figure_1-512c20575f6b4bc6bf23ef34dee0f9c4.png)