Real Property Gain Tax Malaysia 2019

Rpgt payable nett chargeable gain x rpgt rate.

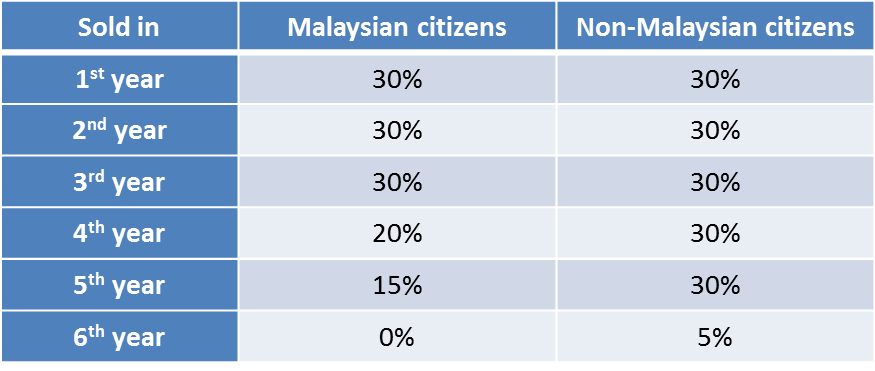

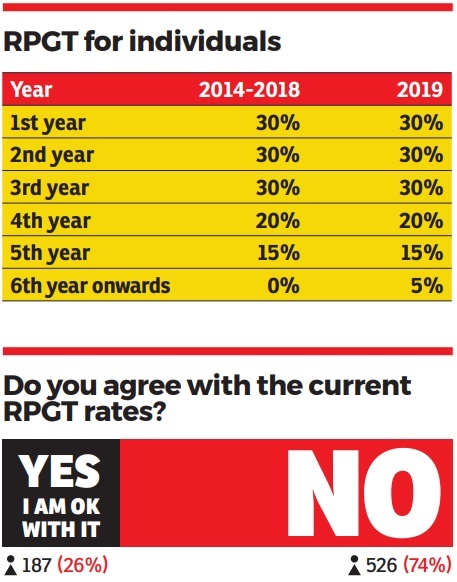

Real property gain tax malaysia 2019. Real property gains tax rpgt in malaysia 2019. Malaysian citizens and or permanent residents who sell their property within the first five years of acquiring it will be subject to rpgt. I believe it impacts a lot more on long term property investors over short term speculators who gain from flipping properties. Real property gains tax rpgt is a form of capital gains tax that homeowners and businesses have to pay when disposing of their property in malaysia.

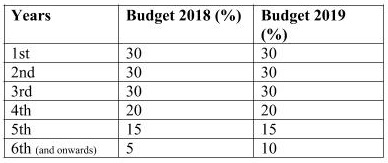

If you sell your house with a loss you don t have to pay any rpgt because you didn t make any profit. Every person whether or not resident is chargeable to rpgt on gains arising from disposal of real property including shares in a real property company rpc. It is the imposition of 5 real property gain tax rpgt for gains received from disposal of properties after the fifth year of owning them. For example if you bought a house for rm250k and sell it at rm350k the profit of rm100k is chargeable under rpgt but you may be entitled to deduct expenses such as legal fees agency commission and renovation cost with proof of receipt and subject to.

7 where the disposer is not a citizen and not a permanent resident or not a company incorporated in malaysia. On top of that malaysians will also be charged 5 in property taxes after the fifth year as according to the budget 2019 rpgt updates. 2019 2020 malaysian tax booklet. Which means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any.

It is the tax which is imposed on the gains when you dispose the property in malaysia. The table is a summary of the rpgt rates applicable to various entities at the date of.