Real Property Gain Tax In Malay

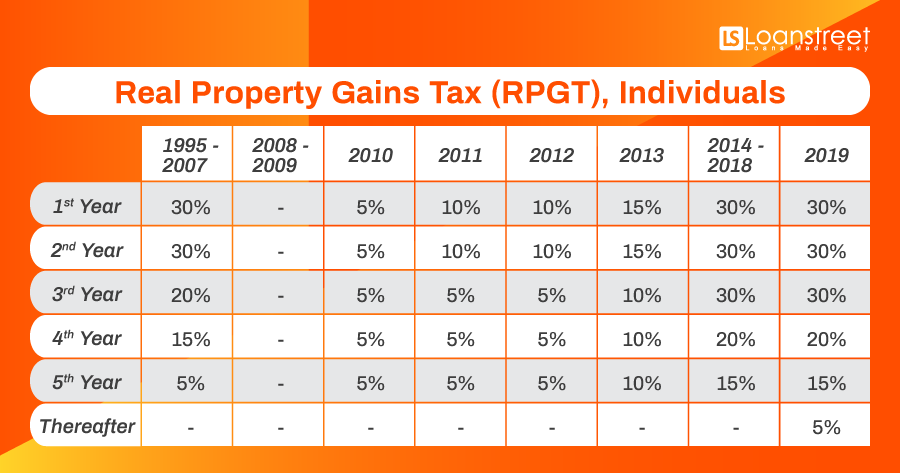

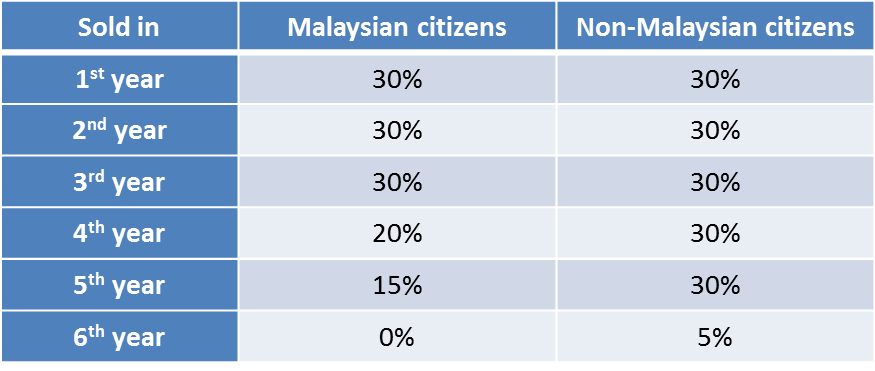

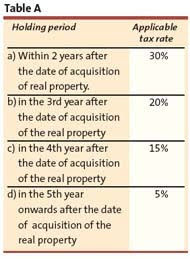

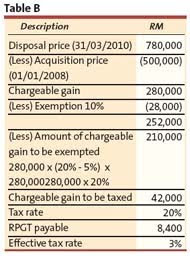

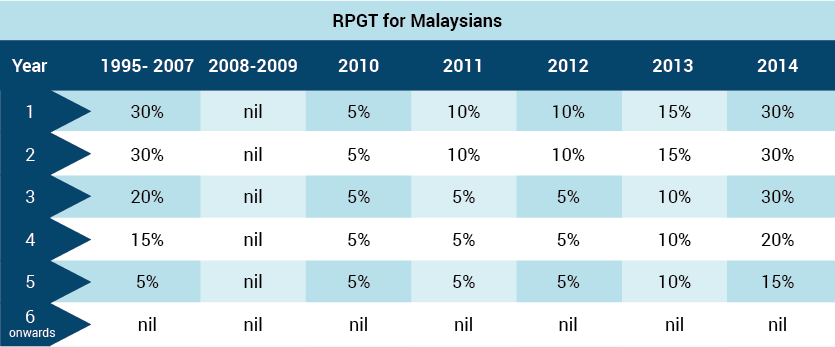

It is the imposition of 5 real property gain tax rpgt for gains received from disposal of properties after the fifth year of owning them.

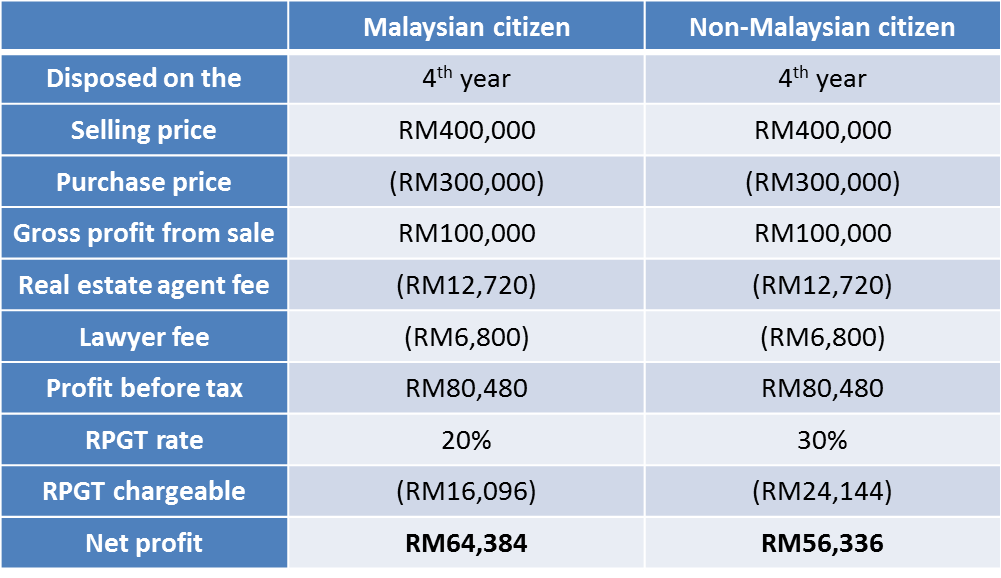

Real property gain tax in malay. Real property gains tax rpgt is a form of capital gains tax that homeowners and businesses have to pay when disposing of their property in malaysia. If you sell your house with a loss you don t have to pay any rpgt because you didn t make any profit. Every person whether or not resident is chargeable to rpgt on gains arising from disposal of real property including shares in a real property company rpc. It includes both residential and commercial properties estates and an empty plot of lands.

Real property gains tax rpgt in malaysia. As such rpgt is only applicable to a seller. Rpc is essentially a controlled company where its total tangible assets consists of 75 or more in real property and or shares in another rpc. In malaysia real property gains tax rpgt is one of the most important property related taxes and is chargeable on the profit gained from selling a property.

Whether you re a property investor or an owner just simply looking to sell your current home to purchase your dream home it s important to be aware of all costs associated with a real estate transaction. Among the measured announced there is one to me that stood out the most. Real property gain tax or in malay is cukai keuntungan harta tanah ckht is a tax imposed on gains derived from the disposal of properties in malaysia. Real property gains tax rpgt is a tax chargeable on the profit gained from the disposal of a property and is payable to the inland revenue board.

Which means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any. A real property gains tax rpgt is the imposition of tax on your profits from selling a property.