Real Estate Investment Trust

Learn more about reits.

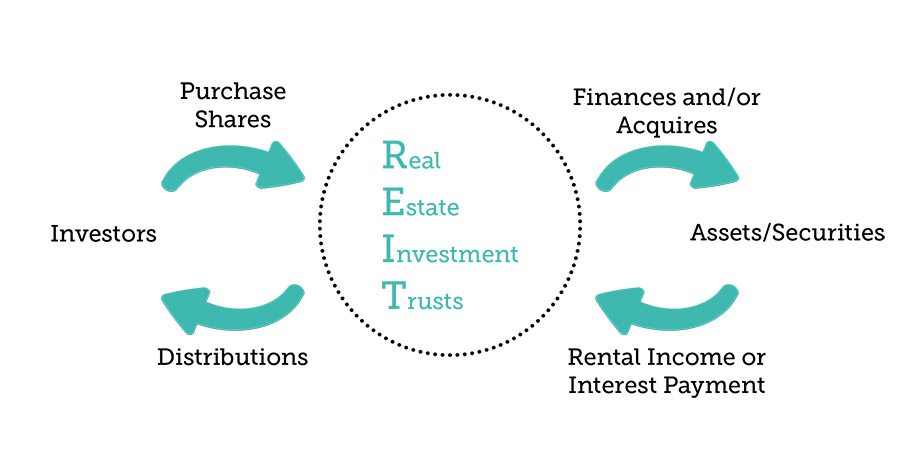

Real estate investment trust. Nareit is the worldwide representative voice for real estate investment trusts reits and publicly traded real estate companies with an interest in u s. If there will be several owners of an investment property a trust is useful for documenting the relationships and ownership interests of all the owners in a consolidated fashion. Modeled after mutual funds reits pool the capital of numerous investors. Nareit advocates for reit based real estate investment with policymakers and the global investment community.

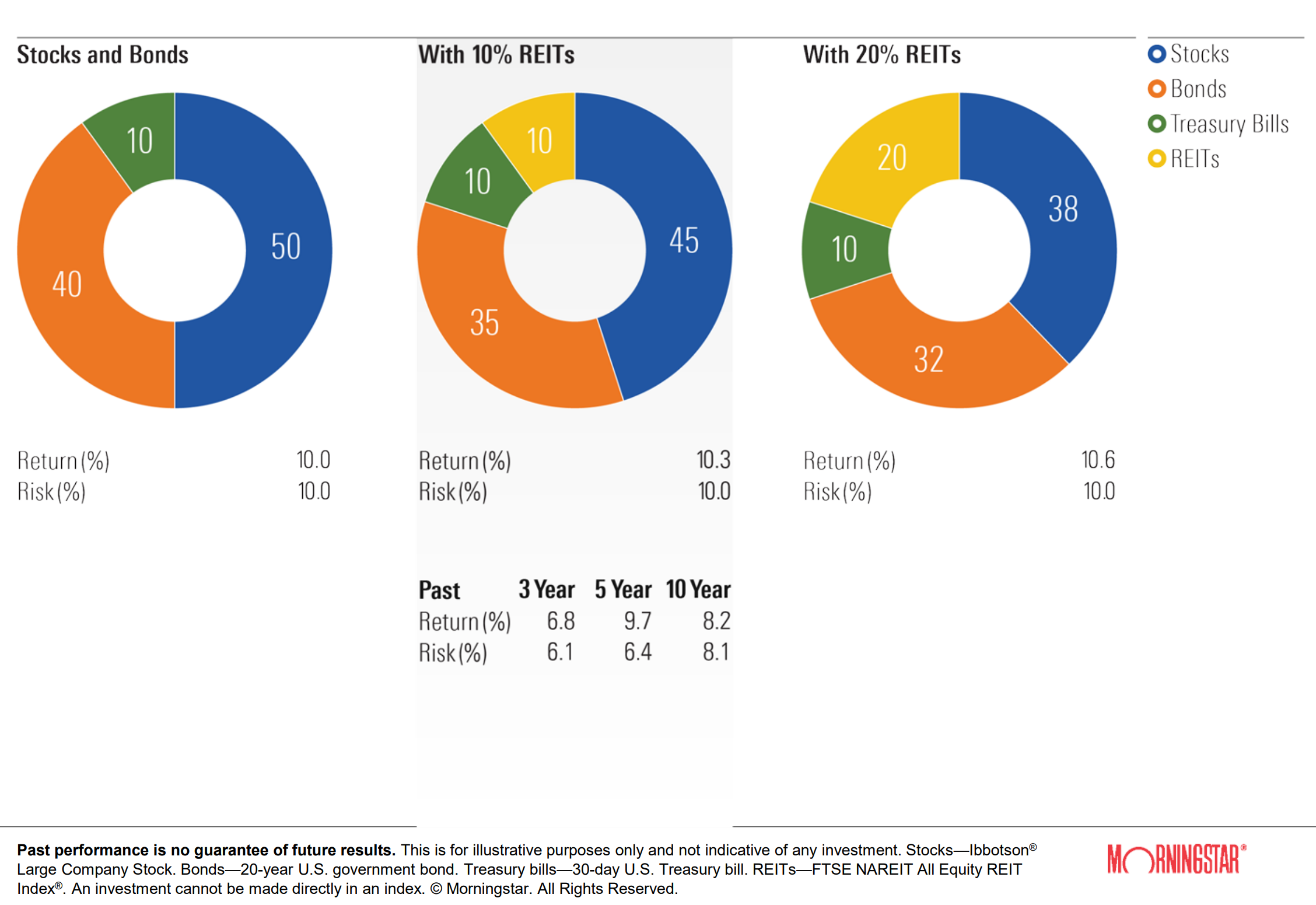

Here s why a real estate trust can be a good option for some investors. If you like dividend stocks reits are a great group to explore. Reits are real estate working for you. While the s p 500 index on average yields less than 2 right now it is relatively easy to find reits with dividend yields of 5 or higher.

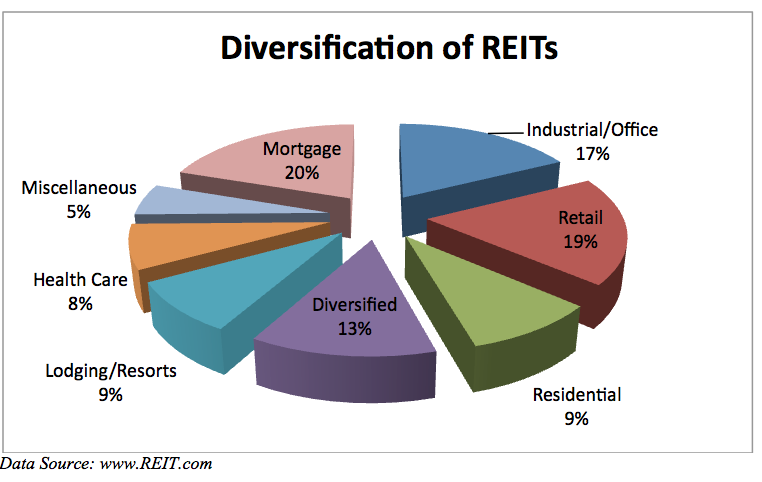

These may include office buildings shopping malls apartments hotels resorts self storage facilities warehouses and mortgages or loans. Real estate investment trusts or reits for short can be fantastic securities for generating meaningful portfolio income. Real estate and capital markets. Most countries laws on reits entitle a real estate company to pay.

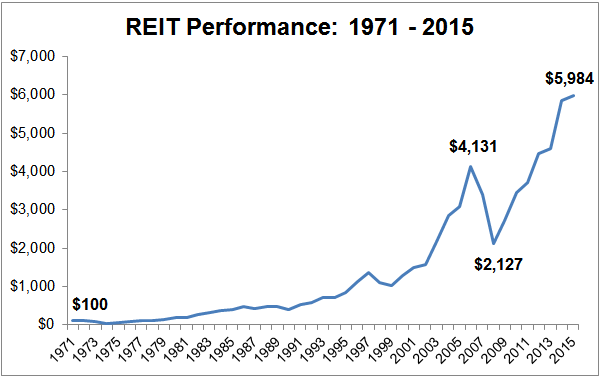

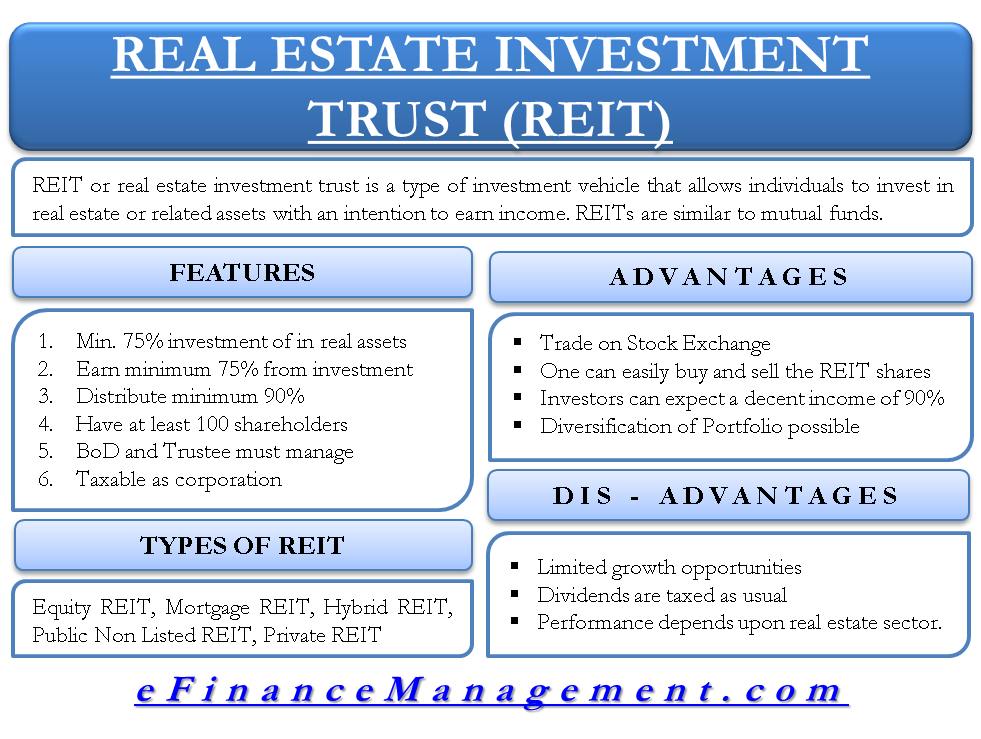

A real estate investment trust reit is a company that owns operates or finances income generating real estate. Real estate investment trusts reits companies that invest in a variety of properties from office buildings to apartments and self storage buildings built big gains in 2019. A reit is a company that owns and typically operates income producing real estate or related assets. Real estate investment trust reit definition a real estate investment trust reit is a publicly traded company that owns operates or finances income producing properties.

Storage real estate investment trusts can help diversify a real estate portfolio. Real estate investment trusts reits allow individuals to invest in large scale income producing real estate.

:max_bytes(150000):strip_icc()/REITFFO-e6fa87094ecc4964be6620a042ec685c.png)

:max_bytes(150000):strip_icc()/GettyImages-1005011746-25886837be3e4e2a832c8c0bd1eb4b59.jpg)